Key Takeaways

- Include Mandatory Fields: Ensure all mandatory fields like supplier and buyer details, GSTIN, and invoice number are included.

- Accurate Tax Calculation: Correctly calculate and apply CGST, SGST/UTGST, or IGST based on the transaction type.

- HSN/SAC Codes: Use the appropriate HSN/SAC codes for goods and services to ensure compliance.

- Clear Descriptions: Provide clear descriptions of goods or services, including quantity and unit price.

- Proper Documentation: Maintain a sequential invoice number and keep copies for records and audits.

In the world of taxation, the GST invoice holds a pivotal role. It’s not just a piece of paper, but a crucial document that ensures compliance with GST regulations. Having a knowledge of what a GST invoice is, its types, and how to create one can help businesses navigate the complexities of GST smoothly.

What Is a GST Invoice?

A GST invoice is a document that a seller issues to a buyer, listing the specifics of the goods or services sold as well as the GST that applies to the transaction. It serves as proof of supply and is essential for claiming input tax credits.

What are the Types of GST Invoices?

1. Bill of Supply

A bill of supply is issued when a registered person is dealing in exempted goods or services or is a composition dealer. It does not include tax details, as the seller is not allowed to charge GST.

2. Aggregate Invoice

An aggregate invoice is used when the value of multiple small invoices does not exceed Rs. 200 each, and the buyer is unregistered. It consolidates multiple invoices into one.

3. Credit Note

A credit note is issued when goods supplied are returned or there is a reduction in the invoice value. It adjusts the GST amount in the original invoice.

4. Debit Note/Supplementary Invoice

A debit note or supplementary invoice is issued when there is an increase in the value of the goods or services after the original invoice has been issued. It reflects the additional GST payable.

5. Reverse Charge Invoice

In certain cases, the recipient of goods or services is liable to pay GST instead of the supplier. This invoice is used in such scenarios, detailing the reverse charge mechanism.

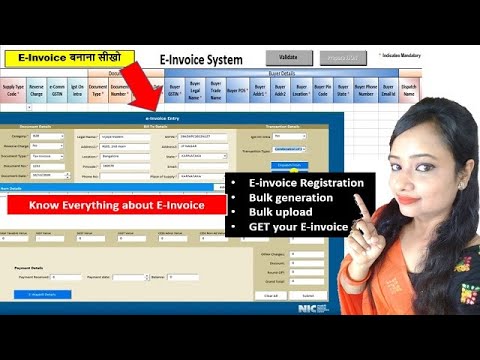

Steps to Generate an E-Invoice

Step 1: Creation of the Invoice on the Taxpayer’s ERP

The first step involves creating the invoice using the taxpayer’s ERP (Enterprise Resource Planning) system. The details of the invoice must be comprehensive and accurate.

Step 2: Generation of the Unique IRN

Once the invoice is created, a unique Invoice Reference Number (IRN) is generated. This step involves uploading the invoice details to the GST portal for validation.

Step 3: Generation of the QR Code

Upon validation, the GST system generates a QR code that contains all the essential details of the invoice. This QR code must be printed on the invoice to complete the e-invoicing process.

How Many Essential Copies for the GST Invoice Should Be Issued?

According to GST rules, three copies of the GST invoice should be issued:

- Original: For the buyer

- Duplicate: For the transporter

- Triplicate: For the seller

Components of a GST Invoice

Mandatory Fields

A GST invoice must include several mandatory fields to ensure compliance with tax regulations. Here are the essential components:

- Supplier’s Details: This includes the supplier’s name, address, and GSTIN (Goods and Services Tax Identification Number).

- Invoice Number and Date: Each invoice must have a unique serial number and the date of issue.

- Buyer’s Details: The buyer’s name, address, and GSTIN (if the buyer is registered under GST).

- Description of Goods or Services: A detailed description of the goods or services provided.

- Quantity and Unit: The quantity of goods supplied and the unit of measurement.

- Total Value: The total value of the goods or services before tax.

- Taxable Value: The value of the goods or services on which GST is calculated.

- GST Rates and Amounts: This includes the rate and amount of CGST (Central GST), SGST/UTGST (State GST/Union Territory GST), and IGST (Integrated GST).

- Place of Supply: The location where the goods or services are supplied.

- Signature of the Supplier: The supplier’s signature or a digital signature for authentication.

These fields ensure that the GST invoice is comprehensive and compliant with tax regulations, facilitating accurate tax filing and audit processes.

Optional Fields

- Optional fields may include the buyer’s order number, delivery note, and terms of sale.

GST Bill Format

Format for Goods

For goods, a GST invoice typically includes the following columns:

- HSN Code: Harmonized System of Nomenclature Code for the Goods.

- Description of Goods: A detailed description of the goods supplied.

- Quantity: The quantity of goods supplied.

- Rate per Unit: The price per unit of the goods.

- Total Value: The total value of the goods before tax.

- Taxable Value: The value of goods on which GST is calculated.

- Applicable GST Rates: Rates for CGST, SGST/UTGST, and IGST.

- GST Amount: The amount of GST charged for CGST, SGST/UTGST, and IGST.

Format for Services

For services, the GST invoice format includes:

- SAC Code: Service Accounting Code for the services.

- Description of Service: A detailed description of the service provided.

- Amount: The amount charged for the service.

- GST Applicable: The applicable GST rates and amounts for CGST, SGST/UTGST, and IGST.

Importance of Correct GST Billing

Compliance

- Accurate GST billing ensures compliance with regulations, avoiding penalties and legal issues. Proper GST invoices include mandatory fields like HSN/SAC codes, customer details, and applicable GST rates (CGST, SGST/UTGST, and IGST).

Avoiding Penalties

- Correct and complete invoices prevent penalties and fines. Ensuring the right format and details, such as invoice serial numbers and billing addresses, protects businesses from these issues.

Tax Invoices

- Accurate GST tax invoices are essential for claiming input tax credits, especially in B2B transactions. A GST-compliant invoice must have correct customer details, service provider information, and a clear description of the goods or services.

Customer Details

- Including accurate customer details (name, address, GSTIN) ensures both parties can claim input tax credits, maintaining correct records and smooth transactions.

Service Provider

- Accurate service provider details (name, address, and GSTIN) ensure accountability and transparency in transactions.

Billing Address

- The billing address determines the place of supply and the applicable GST rates, ensuring correct application of CGST, SGST/UTGST, or IGST.

B2B Invoices

- Correct B2B invoices are necessary for claiming input tax credits and filing accurate GST returns, ensuring proper documentation and compliance.

Relevant Details

- Including all relevant details like HSN/SAC codes, descriptions, unit prices, and GST rates ensures the invoice is complete and accurate, aiding in proper tax records and audits.

Vendor Payments

- Proper invoices help manage vendor payments efficiently, ensuring all transactions are documented and compliant with GST regulations.

E-Way Bill

- Correct invoicing is essential for generating accurate e-way bills required for the movement of goods exceeding a certain value.

Common Mistakes in GST Invoicing

- Incorrect HSN/SAC Codes: Using incorrect or outdated HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) can lead to compliance issues.

- Missing Customer Details: Omitting essential customer details such as name, address, and GSTIN can result in invalid invoices, affecting input tax credit claims.

- Incorrect GST Rates: Applying incorrect GST rates (CGST, SGST/UTGST, IGST) can lead to underpayment or overpayment of taxes, causing compliance problems.

- Incomplete Billing Address: An incomplete billing address can affect the determination of the place of supply, leading to an incorrect tax application.

- Errors in Invoice Serial Number: Using duplicate or incorrect invoice serial numbers can complicate record-keeping and audits.

- Missing Relevant Details: Failing to include relevant details such as quantity, rate per unit, and total value can make the invoice non-compliant.

- Incorrect E-Way Bill: Errors in generating e-way bills for the movement of goods can result in penalties.

- Inaccurate Payment Terms: Not clearly stating payment terms can lead to disputes and delayed payments.

- Bulk Invoicing Errors: Managing bulk invoices without proper checks can lead to multiple errors, affecting overall compliance.

- Non-Compliant Invoices: Issuing non-compliant invoices can lead to rejection during audits and assessments.

How to Make a GST Invoice Using Software?

Benefits of Using Software

Using software for GST invoicing ensures accuracy, saves time, and simplifies compliance. It helps avoid common mistakes, such as incorrect HSN/SAC codes, missing customer details, and errors in GST rates. Software also streamlines bulk invoicing and maintains accurate tax records.

Popular GST Invoicing Software

Some popular GST invoicing software includes Pice Tally, Zoho Books, and QuickBooks, which offer user-friendly interfaces and comprehensive features. It supports various product suites, ensuring accurate tax records and comprehensive transaction records.

GST Invoice for Different Business Scenarios

B2B Transactions

In Business-to-Business (B2B) transactions, the GST invoice must include the buyer’s GSTIN (Goods and Services Tax Identification Number). This allows the buyer to claim an input tax credit. Essential details include:

- Buyer’s GSTIN: Enables input tax credit claims.

- Invoice Number and Date: Ensures unique identification and traceability.

- Description of Goods/Services: Provides clarity on the transaction.

- HSN/SAC Code: Identifies the goods/services supplied.

- Tax Rates and Amounts: Specifies CGST, SGST/UTGST, and IGST.

B2C Transactions

In Business-to-Consumer (B2C) transactions, the buyer is typically unregistered and does not have a GSTIN. The GST invoice for B2C transactions includes:

- Basic Buyer Details: Name and address, if available.

- Invoice Number and Date: For unique identification.

- Description of Goods/Services: Clarity on the transaction.

- HSN/SAC Code: Identifies the goods/services supplied.

- Tax Rates and Amounts: Specifies CGST and SGST for intrastate supplies or IGST for interstate supplies.

Export Invoices

Export invoices must comply with additional requirements to facilitate international trade. Key elements include:

- Type of Export: Specifies whether the export is with or without payment of IGST.

- Shipping Bill Number and Date: Essential for customs and logistics.

- Buyer’s Details: Name, address, and country of the buyer.

- Invoice Number and Date: For unique identification and traceability.

- Description of Goods/Services: A detailed description is needed to avoid customs issues.

- HSN Code: necessary for international classification of goods.

- Tax Rates and Amounts: Specifies if IGST is applied or if it’s zero-rated for export without payment.

Conclusion

Understanding GST invoices, their formats, and the importance of accurate billing can help businesses stay compliant with SGST and UTGST. By leveraging software and being mindful of common mistakes, businesses can streamline their GST invoicing process effectively.

💡Learn more about how our Pice app can help you make all your important business payments, like supplier and vendor payments, rent, GST, & utility, from one single dashboard with your credit card. Request a demo now.

FAQs

What is a GST invoice?

A GST invoice is a document that a registered seller sends to the buyer outlining the supply of goods or services, along with the price and GST applied. It serves as proof of the transaction and is required for claiming input tax credits.

Who should issue a GST invoice?

Any registered business or individual supplying taxable goods or services under GST must issue a GST invoice. This includes both intrastate and interstate transactions.

Who should issue a GST invoice?

A GST invoice must include the supplier’s and buyer’s details, GSTIN, invoice number, date, description of goods/services, HSN/SAC codes, quantity, unit price, total value, taxable value, and GST rates and amounts (CGST, SGST/UTGST, IGST).

When should you issue invoices?

Invoices for goods should be issued before or at the time of removal or delivery. For services, invoices should be issued within 30 days from the date of service supply.

Can you revise invoices issued before GST?

Yes, invoices issued before the implementation of GST can be revised using a revised tax invoice to comply with GST regulations and ensure accurate input tax credit claims.

How many copies of invoices should be issued?

Yes, invoices issued before the implementation of GST can be revised using a revised tax invoice to comply with GST regulations and ensure accurate input tax credit claims.