Key Takeaways

- Rate of Tax Defined: Ensure the rate of tax is correctly defined in Tally to avoid discrepancies in GSTR-3B filings.

- Dealer Type and Details: Select the correct dealer type and input accurate additional details to prevent mismatches.

- Mismatch in Nature of Transaction: Regularly check for mismatches in the nature of transactions and correct them promptly.

- Interstate Transactions and Tax Types: Differentiate between interstate and intrastate transactions, ensuring correct tax types are applied.

- Transaction Values and Conflict Resolution: Address any differences in transaction values and resolve conflicts to maintain accurate GSTR-3B returns.

Handling GSTR-1 and GSTR-3B filings can sometimes present challenges, including mismatches and exceptions that need resolution. This guide outlines common issues and provides solutions to ensure accurate GST returns.

Managing GST compliance in Tally can sometimes lead to mismatches between GSTR-3B and the tax ledger. This guide will help you identify these discrepancies, understand possible reasons for mismatches, and resolve common issues.

Identifying GSTR-3B and GSTR-2A Mismatches

- Count of Transactions

- Check: Ensure that the number of transactions recorded in GSTR-3B matches those in GSTR-2A.

- Action: Review the count of journal transactions and verify against the tax ledger to ensure all transactions are accounted for.

- Natures of Transactions

- Check: Confirm that the nature of transactions is correctly classified in both returns.

- Action: Verify the nature of each transaction in the voucher alteration screen and ensure consistency.

- Invoice Value Difference

- Check: Identify any differences in invoice values between GSTR-3B and GSTR-2A.

- Action: Match the values in the tax ledger with the respective purchase invoices and correct any discrepancies.

- Rate of Tax Modified

- Check: Ensure that the rate of tax applied is consistent across transactions.

- Action: Review rate details and the defined rates in the tax ledger to identify any modifications.

- Required Ledger

- Check: Verify that all necessary ledgers are accurately maintained and reflect the correct tax rates and values.

- Action: Cross-check the required ledger entries with the regular tax rates and make adjustments if necessary.

- Exception Types and Categories

- Check: Identify any exception categories and types that indicate mismatches.

- Action: Review exceptions in the voucher alteration screen and correct the nature of transactions accordingly.

- Purchases from Composition Dealers

- Check: Ensure that purchases from composition dealers are correctly classified.

- Action: Update the dealer type and validate the interstate and intrastate nature of these transactions.

- Accounting Requirements

- Check: Verify that all accounting requirements are met and that transactions are recorded accurately.

- Action: Review accounting entries and ensure they meet GST compliance standards.

- Difference in Tax Amount

- Check: Look for differences in the tax amount between GSTR-3B and GSTR-2A.

- Action: Adjust the tax amounts in the relevant table to match the actual transactions.

- Transaction Details

- Check: Ensure that transaction details are complete and accurate.

- Action: Cross-check transaction details, including invoice status and purchase invoices, to resolve any mismatches.

Possible Reasons for Mismatches

- Resolve Transactions Accidentally Marked for Deletion

- Issue: Transactions incorrectly marked for deletion can cause discrepancies.

- Resolution: Review and restore any transactions mistakenly marked for deletion.

- Change in Company GSTIN

- Issue: Change in the company’s GSTIN may not reflect across all transactions.

- Resolution: Update the company’s GSTIN in all relevant records and ensure consistency across transactions.

- Change in Party Details

- Issue: Changes in party details not updated in all transactions.

- Resolution: Update party details in all relevant transactions to maintain consistency.

- Change in Party GSTIN/UIN

- Issue: Party GSTIN/UIN changes not reflected in transactions.

- Resolution: Ensure that the correct GSTIN/UIN is used for all parties and update the records accordingly.

- Change in GST Amount

- Issue: Inconsistent GST amounts between returns.

- Resolution: Verify and adjust GST amounts to ensure they are accurately reflected in both GSTR-3B and GSTR-2A.

- Change in Voucher Number

- Issue: Discrepancies due to changes in voucher numbers.

- Resolution: Ensure voucher numbers are sequential and match the recorded transactions.

- Deletion of Transaction from Books

- Issue: Transactions deleted without proper adjustment.

- Resolution: Ensure that any deletion is accompanied by proper adjustments and documentation.

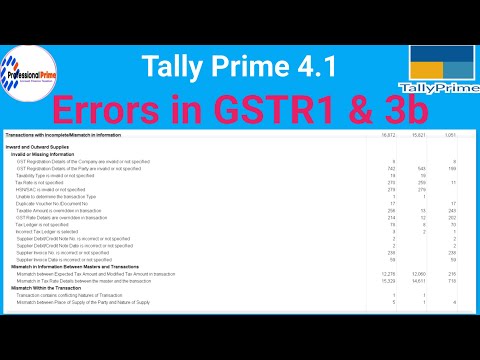

- Invalid or Missing Information

- Issue: Missing or incorrect details in vouchers.

- Resolution: Check for and correct any missing or invalid information in the transaction records.

- Mismatch in Information Between Masters and Transactions

- Issue: Inconsistencies between master data and transactional data.

- Resolution: Regularly reconcile master data with transactional records to maintain accuracy.

Steps to Resolve Transactions Marked for Deletion:

Step 1: Change in Company GSTIN:

- Locate the Transaction: Identify the transaction where the company’s GSTIN needs correction.

- Update the GSTIN: Modify the company GSTIN to the correct one.

- Verify System Records: Ensure that the new GSTIN is updated and properly reflected in the system records.

Step 2: Change in Party:

- Identify the Transaction: Locate the transaction where the party details are incorrect.

- Update Party Details: Change the party information to the correct details in the transaction record.

- Change in Party GSTIN/UIN

Step 3: Change in GST Amount:

- Review the Transaction: Examine the transaction to find the incorrect GST amount.

- Adjust the GST Amount: Correct the GST amount to reflect the accurate value.

Step 4: Change in Voucher Number:

- Search for the Transaction: Locate the transaction with the incorrect voucher number.

- Amend the Voucher Number: Change the voucher number to the correct one according to the records.

Step 5 : Deletion of Transactions from Books:

- Mark for Deletion: Ensure the transaction that needs to be deleted is properly marked for deletion.

- Remove the Transaction: Delete the transaction from the books.

- Verify Deletion: Confirm that the deletion is reflected in all related reports and records.

Step 6: Invalid or Missing Information:

- Inspect the transaction: Check the transaction for any invalid or missing information.

- Update the transaction: Enter the correct and complete details to update the transaction.

Step 7: Mismatch in Information Between Masters and Transactions:

- Cross-Check Information: Compare the information in master records with the transaction details.

- Resolve Discrepancies: Update the transaction or master records to resolve any discrepancies and ensure consistency.

- Find the Transaction: Search for the transaction with the incorrect party GSTIN/UIN.

- Correct the GSTIN/UIN: Update the GSTIN/UIN to match the updated party information.

Conclusion

Maintaining accuracy in GSTR-3B and GSTR-2A filings requires diligent verification and reconciliation of transactions. Regular checks and updates to the tax ledger, rate details, and transaction nature can help identify and resolve mismatches, ensuring compliance with GST regulations.

By addressing possible reasons for mismatches and implementing appropriate resolutions, businesses can achieve error-free GST returns.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses

FAQs

How to solve the mismatch in GSTR-3B in Tally?

To resolve a mismatch, reconcile your GSTR-3B data with your purchase and sales register in Tally. Correct any incorrect entries in the vouchers, such as wrong GST rates or amounts. Adjust the discrepancies in the subsequent GSTR-3B return.

What Happens If GSTR-3B is Filed Wrong?

Filing GSTR-3B incorrectly can result in interest on the unpaid tax, penalties, and late fees. Significant discrepancies may lead to audits and scrutiny from the GST department.

How to remove a GST mismatch while filing a return in accounting software?

Regularly reconcile your purchase and sales data with your accounting software. Ensure accurate entry of details, correct any errors promptly, and use the software’s reconciliation tools to identify and fix mismatches.

What is the penalty for wrongly filing a GST return?

Penalties for wrongly filing of GST returns can include interest on the tax shortfall, late fees, and potential penalties based on the severity of the error and tax department guidelines.

How to rectify entries in Tally?

To rectify entries in Tally, navigate to the specific voucher (Sales, Purchase, etc.), and correct the errors such as incorrect GST rates, amounts, or party details. Save the changes and ensure they reflect accurately in your GST reports.