Key Takeaway

- GST creates a uniform tax structure across India, simplifying compliance and reducing administrative burdens for businesses.

- GST eliminates the cascading effect of taxes through input tax credits, reducing the overall tax burden on goods and services.

- By integrating various indirect taxes into a single framework, GST promotes transparency and efficiency in the taxation system.

- GST supports economic growth by enhancing ease of doing business and fostering a more integrated national market.

- Compared to the previous sales tax and VAT systems, GST offers significant long-term benefits for India’s economic development and tax administration.

What is Sales Tax?

Sales tax is a consumption-based tax levied on the sale of goods and services. It is an indirect tax, meaning the burden of the tax is passed on to the end consumer. The tax is collected by the seller at the point of sale and then remitted to the government. In India, sales tax was a state-level tax, which meant that each state had its own sales tax regulations and rates, leading to a complex and non-uniform tax structure.

Sales taxes can vary significantly from one state to another. The tax rate can depend on the type of goods or services being sold, and some items may be exempt from sales tax altogether. For example, essential goods like food and medicine often have lower sales tax rates or are exempt to reduce the tax burden on consumers.

Key Features of Sales Tax:

- Indirect Taxation: Sales tax is an indirect tax where the burden is passed on to the consumer.

- Varied Rates: Different states impose different sales tax rates.

- Tax at Point of Sale: Collected at the point of sale by the seller.

- State-Level Control: Each state has the authority to set its own tax rates and regulations.

- Limited Input Tax Credits: Limited scope for businesses to claim input tax credits, leading to a cascading tax effect.

- Complex Compliance: Different tax rates and regulations across states make compliance more complex for businesses operating in multiple states.

What is Goods and Service Tax (GST)

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It is a single indirect tax for the entire country, which brings uniformity in taxation. GST was implemented in India on July 1, 2017, replacing multiple indirect taxes such as excise duty, service tax, and VAT (Value-Added Tax), among others.

GST aims to simplify the indirect taxation structure by eliminating the cascading effect of taxes, thus reducing the overall tax burden on goods and services. It covers all stages of the supply chain, from manufacturing to final consumption, and is collected at each stage, with input tax credits available for the tax paid on purchases.

Key Features of GST:

- Comprehensive Tax: GST integrates various indirect taxes like VAT, excise duty, and service tax into a single tax.

- Uniform Tax Rates: GST ensures uniform tax rates across the country.

- Multi-Stage Taxation: Applied at every stage of the production and distribution process.

- Input Tax Credits: Businesses can claim input tax credits for taxes paid on inputs, reducing the overall tax burden.

- Centralized Compliance: Simplifies tax compliance with a centralized tax system.

- Destination-Based Tax: Tax is levied at the point of consumption, not production.

What is GST and its Cascading Effect?

GST eliminates the cascading effect of taxes, which means that tax is levied only on the value addition at each stage of the supply chain. Under the old system, a tax on tax was levied at each stage, increasing the overall tax burden on goods and services. GST, by allowing input tax credits, ensures that businesses can reduce the tax they pay on inputs from the tax they collect on sales, thus eliminating the cascading effect.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

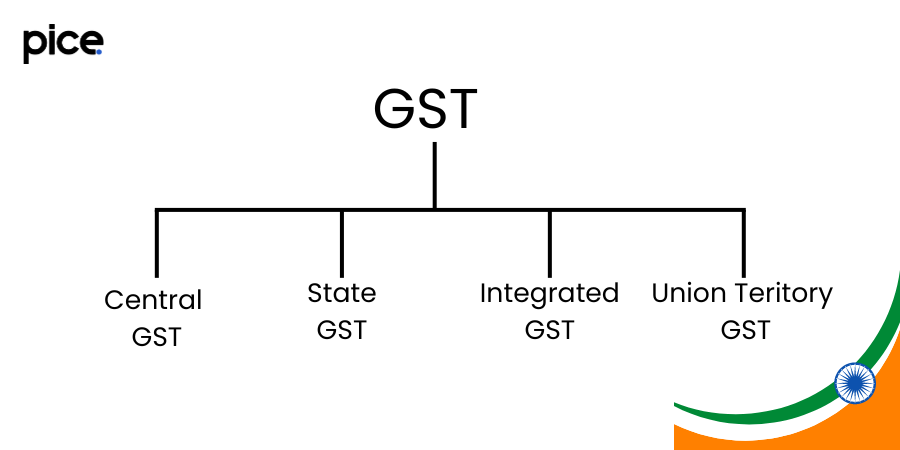

Types of GST in India:

- Central GST (CGST): Collected by the central government on intra-state sales.

- State GST (SGST): Collected by state governments on intra-state sales.

- Integrated GST (IGST): Collected by the central government on inter-state sales and imports.

- Union Territory GST (UTGST): Collected in Union Territories without a legislature.

Differences between GST and Sales Tax

Sales tax and GST have several key differences that impact both businesses and consumers.

- Tax Structure: Sales tax was a state-level tax with varied rates and regulations, while GST is a uniform tax applicable nationwide.

- Input Tax Credits: GST allows for input tax credits, reducing the overall tax burden, whereas sales tax had limited scope for such credits.

- Cascading Effect: GST eliminates the cascading effect of taxes through input tax credits, unlike sales tax which often resulted in tax on tax.

- Point of Taxation: Sales tax was collected at the point of sale, while GST is collected at each stage of the supply chain, ensuring a broader tax base.

- Compliance: GST simplifies compliance with a centralized system, whereas sales tax required businesses to comply with multiple state-level regulations.

Different Kinds of Rates

| Category | GST Rates | Sales Tax Rates | VAT Rates |

|---|---|---|---|

| Essential Goods | 0% to 5% | 0% to 8% | 0% to 5% |

| Standard Goods | 12% to 18% | 8% to 15% | 12.5% to 15% |

| Luxury Goods | 28% | 15% to 20%+ | 20%+ |

| Services | 18% | Varies by state (typically 5% to 15%) | Service tax was 15% (before GST) |

| Petroleum Products | Excluded from GST (varies by state) | Varies by state | Varies by state |

| Alcohol for Human Consumption | Excluded from GST (varies by state) | Varies by state | Varies by state |

| Tobacco Products | 28% + additional cess | Varies by state | Varies by state |

| Basic Food Items | 0% | 0% | 0% |

| Processed Food | 5% to 12% | 5% to 10% | 5% to 12% |

| Medical Supplies | 5% to 12% | 0% to 5% | 5% to 12% |

| Textiles | 5% to 12% | 5% to 10% | 5% to 12% |

| Real Estate | 12% (residential), 18% (commercial) | Varies by state | Varies by state |

Notes:

- GST Rates:

- GST rates are standardized and categorized into 0%, 5%, 12%, 18%, and 28% brackets, with some items like petroleum products and alcohol excluded and taxed by states. The minimum GST rate is 0 and the maximum GST rate is 28%.

- An additional cess may apply to luxury and sin goods like tobacco and luxury cars.

- Sales Tax Rates:

- Sales tax rates varied significantly by state before GST implementation.

- Sales tax was applicable at the state level, leading to diverse rates for different categories of goods and services.

- VAT Rates:

- VAT was also a state-level tax, leading to different rates across states.

- VAT rates applied primarily to goods, with services typically covered under a separate service tax.

This comparison highlights the uniformity and simplification brought by GST in India compared to the previously fragmented sales tax and VAT systems.

Benefits of GST Implementation

GST has brought numerous benefits to the Indian economy, simplifying the tax structure and enhancing efficiency.

- Simplified Tax Structure: Integrates various indirect taxes into a single tax, reducing complexity.

- Enhanced Compliance: Centralized compliance processes make it easier for businesses to adhere to tax regulations.

- Reduction in Tax Burden: Elimination of the cascading effect reduces the overall tax burden on goods and services.

- Boost to Economy: Uniform tax rates and easier compliance boost economic growth and reduce tax evasion.

- Encourages Transparency: Digital compliance and uniform regulations promote transparency in the taxation system.

Examples

- Office Supplies: Under the sales tax system, businesses purchasing office supplies had to pay sales tax at each stage of production, leading to a higher overall cost. With GST, input tax credits reduce the tax burden, lowering costs.

- Inter-State Supply: A business selling goods from one state to another faced multiple sales tax regulations. GST simplifies this with IGST, a single tax on inter-state transactions.

- Digital Products: Digital products faced varied sales tax rates across states. GST applies a uniform rate, making it easier for digital businesses to operate nationwide.

- Luxury Tax: High sales tax rates on luxury items made them expensive. GST applies a standardized rate, making luxury items more affordable.

- Filing of Returns: Sales tax required separate returns for each state. GST allows for centralized filing, simplifying the compliance process for businesses.

Conclusion: Which System is Better for India?

The transition from sales tax and VAT to the Goods and Services Tax (GST) in India represents a significant reform in the country’s indirect taxation system. When comparing these systems, it is crucial to consider several factors including central taxes, income tax, the role of tax authorities, and the broader implications for direct taxes.

Uniformity in Central Taxes: GST has created a uniform tax structure across India, replacing the previously fragmented system where each state had its own sales tax rates and VAT regulations. This uniformity reduces the complexity of compliance for businesses operating in multiple states and fosters a more integrated market. The centralization under GST ensures that central taxes are uniformly applied, making the tax system more predictable and easier to navigate for businesses.

Impact on Income Tax and Direct Taxes: While GST primarily addresses indirect taxes, its implementation has indirect benefits for direct taxes like income tax. By reducing the tax burden on goods and services through input tax credits, GST can lead to lower production costs and potentially higher profitability for businesses. This, in turn, could increase taxable income and thereby the collection of income tax and other direct taxes. Moreover, a streamlined GST regime can free up resources within tax authorities to better focus on direct tax compliance and enforcement.

Role of Tax Authorities: Under the previous system, businesses had to deal with multiple tax authorities across different states, leading to significant administrative burdens and opportunities for tax evasion. GST simplifies this by establishing a single, nationwide tax framework, reducing the number of interactions businesses must have with tax authorities. This not only makes compliance easier but also enhances the efficiency of tax administration. Tax authorities can now focus more on ensuring accurate tax compliance rather than managing a complex web of state-specific regulations.

Reduction in Tax Compliance Complexity: The GST system significantly reduces the complexity associated with tax compliance. Businesses no longer need to navigate the varied regulations of state-level sales taxes and VAT, which often led to confusion and increased administrative costs. With GST, compliance requirements are more uniform, and processes like filing returns are streamlined. This reduction in complexity benefits not only large businesses but also small and medium enterprises (SMEs), which often struggled with the administrative burden of the old system.

Overall Economic Impact: The implementation of GST has broader economic implications. By eliminating the cascading effect of taxes, GST reduces the overall tax burden on goods and services, which can lower prices for consumers and boost consumption. Additionally, the transparency and efficiency brought by GST can enhance investor confidence and make India a more attractive destination for foreign investment. The streamlined tax regime can also lead to better resource allocation and productivity within the economy.

In conclusion, the GST system offers numerous advantages over the previous sales tax and VAT systems. By creating a uniform and centralized tax structure, reducing compliance complexity, and improving the efficiency of tax authorities, GST is better suited to the needs of a modern and integrated economy like India. While the transition has not been without challenges, the long-term benefits of GST make it a superior system for India’s economic growth and development.

FAQs

What are consumption taxes?

Consumption taxes are levied on goods and services purchased by consumers. These taxes are typically included in the final price paid by the consumer and are collected by the seller on behalf of the government. Common examples include sales tax, value-added tax (VAT), and goods and services tax (GST).

Who pays sales tax, VAT, and GST?

Sales tax, VAT, and GST are paid by the end consumer purchasing goods or services. Businesses collect these taxes at the point of sale and remit them to the government. While the tax is imposed on consumers, businesses act as intermediaries in collecting and paying these taxes.

What is Value-added Tax (VAT)?

Value-added Tax (VAT) is a type of consumption tax that is levied on the value added to goods and services at each stage of production or distribution. Unlike sales tax, which is collected only at the point of sale to the final consumer, VAT is collected at each stage of the supply chain, with businesses able to claim credits for the VAT paid on their inputs.

What is the Difference Between GST and VAT?

The primary difference between GST and VAT is that GST is a comprehensive tax that replaces multiple indirect taxes (like VAT, service tax, and excise duty) with a single unified tax structure. GST simplifies compliance by having uniform rates across the country, whereas VAT was state-specific with varying rates and rules, leading to complexity and inefficiency in tax administration.

What does GST bring in that VAT could not?

GST brings in uniformity across the country with a single tax rate, eliminating the cascading effect of taxes through the provision of input tax credits. It simplifies the tax structure, reduces compliance costs, and creates a more transparent system. GST also facilitates a seamless flow of goods and services across state borders, boosting economic efficiency.

What Is Indirect Tax?

Indirect tax is a type of tax collected by an intermediary (such as a retailer) from the person who bears the ultimate economic burden of the tax (such as the consumer). Examples include sales tax, VAT, and GST. These taxes are levied on the production, sale, or consumption of goods and services and are included in the price of the goods or services.

Is sales tax and GST the same in India?

No, sales tax and GST are not the same in India. Sales tax was a state-level tax applied to the sale of goods within a state, leading to different rates and regulations across states. GST, on the other hand, is a unified national tax that replaces sales tax and other indirect taxes, providing a consistent tax structure across the country.