Key Takeaways

- GST returns must be filed monthly or quarterly, depending on turnover.

- GSTR-1 and GSTR-3B can be amended to correct errors or omissions.

- Critical details like GSTIN and invoice number/date cannot be amended at the invoice level.

- All registered taxpayers are required to file an annual return (GSTR-9).

- Using automated tools and regular verification can prevent common GST annual return filing errors.

If you’re running a business in India, GST is a term you should be well-acquainted with. Goods and Services Tax (GST) is a comprehensive tax levied on the supply of goods and services in India. One of the crucial aspects of GST compliance is the filing of GST applicable returns. But what exactly is a GST return, and why is it so important? Let’s dive in!

What is a GST Return?

A GST return is a document that a taxpayer registered under the Goods and Services Tax (GST) law must file with the tax authorities. The government uses this document to determine the taxpayer’s tax liability by providing details about taxes on the taxpayer’s income (sales) and expenses (purchases).

Essentially, a GST return is a record of all transactions made during a specific return period, including the amount of GST collected on sales and the amount of GST paid on purchases. Filing GST returns is a mandatory compliance requirement for all businesses registered under GST, and it helps ensure that the correct amount of tax is collected and remitted to the government.

The Frequency of Filing GST Returns

Filing GST returns on time is a crucial aspect of maintaining compliance under the GST regime. The frequency of filing these accurate returns varies depending on the type of taxpayer and the specific requirements outlined by GST laws. Here’s a detailed look at the different frequencies for filing GST returns and relevant keywords to help you understand the process better.

Monthly Returns

- Regular Taxpayers: Businesses with an annual turnover exceeding ₹1.5 crores are required to file their GST returns on a monthly basis. This includes forms like GSTR-1 and GSTR-3B. Monthly filings ensure that the tax authorities receive regular updates on business transactions and tax liabilities.

Quarterly Returns

- Small Taxpayers: Taxpayers with an annual turnover of up to ₹1.5 crores can opt for quarterly return filing under the QRMP (Quarterly Return Monthly Payment) scheme. This scheme allows small businesses to reduce their compliance burden by filing GSTR-1 and GSTR-3B quarterly instead of monthly. However, they must still pay taxes on a monthly basis.

Annual Returns

- All Registered Taxpayers: Apart from the regular monthly or quarterly returns, all registered taxpayers must file an annual return (GSTR-9). This return consolidates the information provided in the monthly or quarterly returns filed throughout the financial year. It includes details like total outward and inward supplies, tax paid, and input tax credit claimed.

Composition Dealers

Simplified Compliance: Composition scheme dealers, who have a turnover of up to ₹1.5 crores, are required to file GSTR-4 annually. This is a simplified return that consolidates the quarterly returns filed throughout the year. Composition dealers benefit from a reduced tax rate and simplified return filing process.

Special Cases

- Reverse Charge: Certain transactions are subject to reverse charge, where the recipient of the goods or services is liable to pay GST instead of the supplier. These transactions must be reported accurately in the GSTR-1.

- Amendments: Amendments to GSTR-1 can be made to correct any errors or omissions in previously filed returns. This can include invoice level amendments, adjustments to tax periods, and correcting the details of invoices.

How to ensure accurate filing of GSTR-1?

- Valid Invoice: Ensure all invoices are valid and accurately reflect the transaction details. This includes the correct GSTIN, taxable value, and tax amounts.

- Automated Tools: Use reliable accounting software or ERP solutions to automate the return filing process. This minimizes errors and ensures timely submission.

- Online Portal: Regularly use the GST online portal to verify details, file returns, and check the status of submissions. The portal provides tools to help taxpayers stay compliant.

Types of GST Returns

There are several types of GST returns, each serving a different purpose. Here are some of the main ones:

| Return Type | Description | Frequency | Who Should File |

|---|---|---|---|

| GSTR-1 | Details of outward supplies of goods and services | Monthly/Quarterly | Regular taxpayers |

| GSTR-2A | Auto-generated details of inward supplies | Auto-generated | View only for regular taxpayers |

| GSTR-3B | Summary of outward supplies, input tax credit, and payment | Monthly | Regular taxpayers |

| GSTR-4 | Quarterly return for composition scheme taxpayers | Quarterly/Annual | Composition scheme taxpayers |

| GSTR-5 | Return for non-resident foreign taxable person | Monthly | Non-resident foreign taxpayers |

| GSTR-6 | Returns for input service distributor | Monthly | Input service distributors |

| GSTR-7 | Return for authorities deducting tax at source (TDS) | Monthly | Tax deductors |

| GSTR-8 | Return for e-commerce operators collecting tax at source | Monthly | E-commerce operators |

| GSTR-9 | Annual return | Annually | Regular taxpayers |

| GSTR-9A | Annual return for composition scheme taxpayers | Annually | Composition scheme taxpayers |

| GSTR-10 | Final return | Once (after GST cancellation) | Taxpayers whose GST registration is canceled |

| GSTR-11 | Return for taxpayers with UIN claiming refund | Monthly | Taxpayers with Unique Identification Number (UIN) |

Can GST Returns Be Amended or Corrected?

Yes, GST returns can be amended or corrected. This is essential for businesses to rectify any errors or omissions that might have occurred during the initial filing. Here’s how amendments and corrections can be made:

Amendments in GST Returns

- Time Limit for Amendments: Amendments to a GST return can typically be made until the filing date of the next return. For example, errors in a monthly return can be corrected until the due date of the return for the next month. However, amendments must be made within the financial year to which the return pertains or by the date of filing the annual return, whichever is earlier.

- Procedure for Amendment:

- Login to GST Portal: Access the GST portal using your credentials.

- Navigate to Returns Section: Go to ‘Services’ > ‘Returns’ > ‘Returns Dashboard’.

- Select the Period: Choose the financial year and return filing period.

- Edit the Details: Click on the specific return you want to amend and make the necessary changes.

- Submit the Return: After making the amendments, submit the return.

Limitations of Amendments

- Past Period Restrictions: Amendments cannot be made to returns of previous financial years once the annual return for that year is filed.

- No Deletion: You cannot delete any transaction, but you can amend it to correct the details.

What is GSTR-1?

GSTR-1 is a monthly or quarterly return that contains details of all outward supplies of goods and services made by a registered taxpayer under the Goods and Services Tax (GST) regime in India. Essentially, GSTR-1 captures the sales transactions of a business for a given period.

Who Should File GSTR-1?

Every registered person under GST, except for a few exceptions like composition scheme taxpayers, input service distributors, and non-resident taxable persons, is required to file GSTR-1. The frequency of filing GSTR-1 depends on the turnover of the taxpayer:

- Monthly Filing: Taxpayers with an annual turnover exceeding ₹1.5 crores must file GSTR-1 on a monthly basis.

- Quarterly Filing: Taxpayers with an annual turnover of up to ₹1.5 crores can opt to file GSTR-1 on a quarterly basis.

Details Included in GSTR-1

- Business Information: Basic details such as the GSTIN, legal name, and trade name of the business.

- Invoice-wise Details: Comprehensive information about each invoice issued during the period, including the invoice number, date, value, and the amount of tax charged.

- HSN Summary: Details of goods supplied categorized by the Harmonized System of Nomenclature (HSN) code.

- B2B Transactions: Details of sales made to other registered businesses (Business-to-Business).

- B2C Transactions: Details of sales made to unregistered individuals and consumers (Business-to-Consumer).

- Exports: Information about goods and services exported outside India.

- Credit and Debit Notes: Details of any credit or debit notes issued during the period, including amendments to invoices.

- Nil-rated, Exempt, and Non-GST Supplies: Details of supplies that are either exempt from GST, nil-rated, or non-GST supplies.

What is an Amendment in GSTR-1?

An amendment in GSTR-1 refers to the process of making changes or corrections to the details of outward supplies of goods and services that were previously filed in the GSTR-1 return. This allows businesses to rectify any mistakes or omissions that might have occurred during the initial filing.

Reasons for Amendments

Amendments in GSTR-1 are necessary for various reasons, including:

- Incorrect Invoice Details: Errors in the invoice number, date, or value.

- Wrong GSTIN of the Recipient: Mistakes in the recipient’s GST Identification Number.

- Tax Amount Corrections: Incorrect tax rates or tax amounts charged.

- Missed Invoices: Invoices that were not included in the original return.

Scope of Amendments

The amendments in GSTR-1 can include:

- Editing Invoice Details: Correcting errors in previously uploaded invoices.

- Adding New Invoices: Adding invoices that were missed in the original return.

- Editing Debit/Credit Notes: Making changes to previously submitted debit or credit notes.

- Correcting B2B, B2C, and Export Transactions: Amending transaction details for business-to-business, business-to-consumer, and export sales.

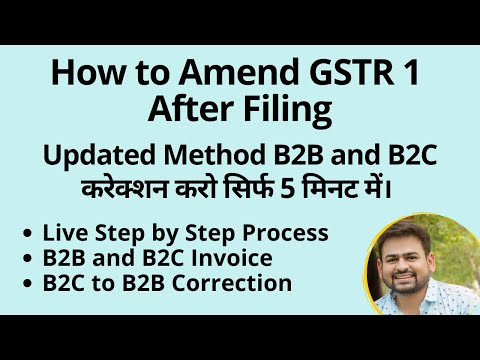

Procedure for Amendment in GSTR-1

Step-by-Step Guide

Step 1: Login to the GST Portal: Access the GST portal using your credentials.

Step 2: Navigate to Services: Go to ‘Services’ > ‘Returns’ > ‘Returns Dashboard’.

Step 3: Select the Period: Choose the financial year and return filing period.

Step 4: Edit the Details: Click on ‘Amendment’ and make the necessary changes.

Step 5: Submit: Once the amendments are made, submit the return.

Important Deadlines

Amendments to GSTR-1 can generally be made until the due date of the return for the month of September following the end of the financial year or the date of filing the annual return, whichever is earlier. This means that businesses have a limited window to correct any errors from previous returns.

Things to Keep in Mind While Making Amendments to GSTR-1

Amending GSTR-1 is a critical task that requires precision and attention to detail to ensure accuracy and compliance. Here are some important considerations and relevant keywords to keep in mind while making amendments:

1. Double-Check All Entries

Before submitting any amendments, thoroughly review all the details to ensure that the corrections are accurate. This includes invoice numbers, dates, taxable values, and GST amounts.

2. Adhere to Deadlines

Amendments can only be made within a specific time frame. Generally, you can amend GSTR-1 until the due date for the return for the month of September following the end of the financial year, or the date of filing the annual return, whichever is earlier. Make sure you complete all necessary amendments within this period to avoid penalties.

3. Maintain Proper Documentation

Keep detailed records of all amendments made. This includes original invoices, amended invoices, debit/credit notes, and any other relevant documents. Proper documentation is essential for audit purposes and future reference.

4. Use Correct Invoice Numbers

Ensure that the invoice numbers used in the amendments match those in your accounting records. Avoid duplicating or skipping invoice numbers, as this can cause discrepancies.

5. Verify Recipient Details

Double-check the GSTIN and other details of the recipients to avoid errors. Incorrect recipient details can lead to mismatches in their records, causing issues with input tax credit claims.

6. Understand Common Errors

Be aware of common mistakes that occur during amendments:

- Incorrect GSTINs

- Wrong invoice dates

- Mismatched taxable values and tax amounts

7. Use Accounting Software

If possible, use reliable accounting software to help manage and automate your GST return filing and amendments. This can minimize manual errors and streamline the process.

8. Inform Affected Parties

If amendments impact your customers or suppliers, such as changes to invoice details or tax amounts, inform them promptly. Clear communication helps prevent confusion and ensures that their records are also updated.

9. Avoid Multiple Amendments

Try to minimize the number of amendments by reviewing and validating your data before the initial filing. Frequent amendments can complicate your records and increase the risk of errors.

10. Monitor Amendment Status

After submitting the amendments, regularly check the status on the GST portal to ensure they have been processed correctly. Address any issues or discrepancies that arise promptly.

11. Keep Updated with GST Laws

GST laws and rules are subject to change. Stay informed about any updates or changes in the regulations related to amendments in GSTR-1 to ensure compliance.

What are the Late Fees That Can Be Incurred on GSTR-1?

Filing GSTR-1 on time is essential to avoid late fees and penalties. Here’s a detailed look at the late fees that can be incurred if you miss the deadline for filing GSTR-1

Fee Structure

- Monthly Returns: If the GSTR-1 return is not filed within the due date, a late fee of ₹50 per day (₹25 CGST + ₹25 SGST) is applicable. For nil returns, the late fee is ₹20 per day (₹10 CGST + ₹10 SGST).

- Quarterly Returns: The same late fee structure applies to quarterly filings. If you miss the deadline, you incur ₹50 per day, and for nil returns, it is ₹20 per day.

Maximum Penalty

- The maximum late fee can go up to ₹10,000 (₹5,000 CGST + ₹5,000 SGST) for each return.

Keywords: Maximum Penalty, GSTR-1 Return File, GST Compliance

Impact of Late Filing

- Financial Penalties: The cumulative late fees can add up, leading to significant financial penalties.

- Compliance Rating: Late filing negatively affects your GST compliance rating, which can lead to increased scrutiny and audits.

- Blocking of E-Way Bill: If returns are not filed for two consecutive periods, the generation of e-way bills might be blocked, impacting the movement of goods.

Avoiding Late Fees

- Timely Filing: Ensure that GSTR-1 is filed within the stipulated deadlines to avoid late fees.

- Automated Reminders: Use accounting software or ERP systems that send reminders before the due dates.

- Regular Review: Regularly review your transactions and GST returns to ensure accuracy and timely submission.

List of Error Messages and Mistakes Made Behind Errors

Common Error Messages

- Invalid GSTIN : This occurs when the GST Identification Number (GSTIN) of the recipient is entered incorrectly, leading to mismatches in the tax records.

- Mismatch in invoice details: Errors in the invoice details, such as incorrect GST tax invoice numbers, dates, or taxable values, can cause discrepancies and prevent successful filing.

- Incorrect tax calculations: Manual errors in calculating GST components (CGST, SGST, IGST) can lead to inaccurate tax amounts, resulting in filing rejections.

How to Avoid These Errors

- Verify GSTIN using the GST portal: Before submitting your GSTR-1 return, ensure that the GSTIN of the recipient is valid and correct. Use the GST portal’s search function to verify the GSTIN details to prevent errors.

- Cross-check invoice details: Thoroughly review all invoice details, including invoice numbers, dates, and taxable values, before submission. Regular reconciliation and validation can help catch and correct any discrepancies.

- Use automated tools for tax calculations: Implement reliable accounting software to automate tax calculations. Automated tools reduce the risk of manual errors and ensure accurate application of GST rates and calculations.

What Amendments or Corrections Can Be Made to GST Returns?

- Invoice Corrections:

- Amend Invoice Details: Corrections can be made to details such as invoice number, date, taxable value, and tax amount.

- Add Missing Invoices: Any invoices that were omitted in the original return can be added.

- Credit/Debit Notes:

- Amendments can be made to credit and debit notes if there were errors in the initial reporting.

- Recipient Details:

- Correcting the GSTIN of the recipient if it was entered incorrectly.

- Tax Amounts:

- Corrections to the tax amounts, including IGST, CGST, and SGST.

Conclusion

Filing GST returns is a critical aspect of running a business in India. Understanding the different types of returns, their filing frequencies, and the procedures for making amendments can help in maintaining compliance and avoiding penalties. By keeping a keen eye on the details and adhering to best practices, businesses can navigate the complexities of GST with ease.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

FAQs

What is the frequency of filing GST returns?

The frequency of filing GST returns varies based on the taxpayer’s annual turnover. Businesses with a turnover exceeding ₹1.5 crores must file GSTR-1 and GSTR-3B monthly. Those with a turnover up to ₹1.5 crores can opt for quarterly filing under the QRMP scheme. Additionally, all registered taxpayers must file an annual return (GSTR-9) consolidating their yearly transactions.

Can GST returns be amended or corrected?

Yes, GST returns can be amended or corrected to rectify errors or omissions. Amendments can be made until the due date for the return for the month of September following the end of the financial year or the date of filing the annual return, whichever is earlier. This helps ensure accuracy and compliance in tax filings.

Which details cannot be amended at the invoice level?

At the invoice level, you cannot amend the GSTIN of the recipient, the place of supply, or the invoice number and date. These details are crucial for the integrity of the tax records and must be accurate at the time of the original filing.

Which GST returns can be amended or corrected?

The primary GST returns that can be amended or corrected are GSTR-1 and GSTR-3B. These amendments allow businesses to update their outward supplies and tax liabilities, respectively. The annual return (GSTR-9) can also incorporate corrections made throughout the year.

What amendments or corrections can be made to GST returns?

Amendments to GST returns can include corrections to invoice details such as taxable value, tax amounts, and the addition of missing invoices. Debit and credit notes can also be amended. However, fundamental details like the GSTIN of the recipient and invoice date cannot be changed.

How can I avoid errors in GST returns?

To avoid errors in GST returns, regularly verify the GSTIN using the GST portal, cross-check all invoice details before submission, and use automated tools for tax calculations. Regular internal audits and timely reconciliation of accounts can also help maintain accuracy and compliance.