Key Takeaway

- Excel sheets provide a flexible and customizable tool for GST calculation, allowing businesses to meet specific tax needs efficiently.

- Accurate and automatic GST calculations are possible using Excel’s functions and formulas, minimizing the risk of errors.

- Excel’s efficient record-keeping capabilities streamline the GST filing process, ensuring compliance with tax regulations.

- Updating tax rates and making adjustments in Excel is easy, helping businesses stay up-to-date with the latest GST requirements.

- Utilizing Excel for GST calculations is cost-effective and enhances compliance, making it an attractive option for businesses of all sizes.

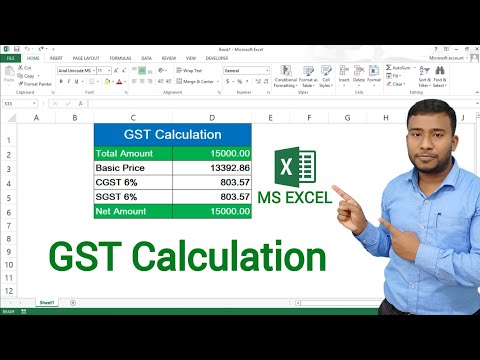

Calculating GST in Excel sheets is a straightforward process that leverages Excel’s powerful functions and formulas to ensure accuracy and efficiency. To begin, create a structured GST Calculation Sheet with columns for essential data such as the original price of goods or services, applicable GST rates, and any additional costs like courier charges. Use simple percentage calculations to determine the GST output tax for sales and the GST input tax for purchases.

By applying the relevant tax rate to the original price, Excel can automatically calculate the GST amounts. Summarize these calculations in a dedicated section to determine the net GST liability by subtracting the input tax from the output tax. This structured approach not only simplifies the GST calculation process but also helps in maintaining accurate records for filing GST returns, ensuring compliance with tax regulations and streamlining the overall GST filing process.

Benefits of Using Excel Sheets for GST Calculation

Using Excel sheets for GST calculation offers numerous advantages that make managing taxes more efficient and straightforward for businesses of all sizes.

Customization and Flexibility

Excel provides the flexibility to tailor the GST Calculation Sheet to meet specific business needs. Businesses can create templates that suit their unique transaction types and tax requirements, incorporating various components such as tax rates, original prices, courier charges, and vendor payments. This customization ensures that all relevant data is captured and organized effectively.

Accurate Calculations

Excel’s powerful functions and formulas facilitate accurate and automatic GST calculations. Simple percentage calculations can be used to determine GST on sales and purchases, minimizing the risk of human error. This accuracy is crucial for determining the correct GST liability and ensuring compliance with tax regulations.

Efficient Record-Keeping

Maintaining detailed records is essential for filing GST returns and complying with business regulations. Excel enables efficient record-keeping by allowing users to track all transactions in a single, organized spreadsheet. This centralized record-keeping simplifies the GST filing process and ensures that all necessary information is readily available when needed.

Easy Updates and Adjustments

Tax rates and regulations can change frequently, and Excel makes it easy to update these changes across the GST calculation sheet. Users can quickly adjust tax rates, add new columns for additional data, or modify existing formulas without having to start from scratch. This adaptability helps businesses stay up-to-date with the latest GST requirements.

Cost-Effective Solution

Excel is a cost-effective solution for GST calculation, especially for small and medium-sized enterprises. Unlike specialized accounting software that may require significant investment, Excel is widely accessible and affordable. Businesses can leverage Excel’s capabilities without incurring additional costs, making it an attractive option for managing GST calculations.

Enhanced Compliance

Using Excel for GST calculations helps businesses ensure compliance with GST regulations. By maintaining accurate and organized records, businesses can easily prepare and file GST returns such as GSTR-3B. This organized approach reduces the likelihood of errors or omissions, which can lead to penalties or audits.

Integration with Other Business Processes

Excel can seamlessly integrate with other business processes and systems, enhancing overall efficiency. Data from sales, purchases, and other transactions can be imported into the GST Calculation Sheet, streamlining the entire process. This integration supports a holistic approach to business management, where GST calculations are part of a broader financial strategy.

Essential Components of a GST Payable Calculator Template

An effective GST Payable Calculator Template in Excel should include various components to capture all necessary data for accurate GST calculations. Below are the key components that should be included in such a template:

1. Tax Rate Input : This column allows users to input the applicable GST rates for different goods or services. It ensures that the correct tax rate is applied to each transaction.

2. Original Price: This column records the pre-tax price of goods or services. It serves as the basis for calculating the GST amount.

3. GST Output Tax Calculations: This section calculates the GST on sales (output tax). It typically involves multiplying the original price by the applicable GST rate.

4. GST Input Tax Calculations: This section calculates the GST on purchases (input tax). Similar to the output tax calculations, it involves multiplying the original price by the applicable GST rate.

5. Vendor Payments: This component tracks payments made to vendors, including the GST amount. It helps in managing vendor accounts and ensuring that input tax credits are accurately claimed.

6. Courier Charges: If applicable, this column includes any courier or shipping charges along with the GST. It ensures that all additional costs are accounted for in the overall GST calculation.

7. Cess Column: For products subject to additional cess, this column records the cess amount. It ensures that any extra taxes are included in the total tax liability.

8. Inter-state and Intra-state Transactions: Separate sections for inter-state and intra-state transactions help in applying the correct GST rates (IGST for inter-state and CGST/SGST for intra-state). This distinction is crucial for accurate GST reporting.

9. GST Liability: This section summarizes the total GST liability. It is calculated by subtracting the total input tax from the total output tax. This net amount represents the GST payable to the government.

10. GST Returns: This section is dedicated to preparing and filing GST returns, such as the GSTR-3B Calculation Sheet. It ensures that all necessary data is compiled and ready for submission.

11. Summary Totals: A summary section that consolidates total sales, total purchases, total GST collected, total GST paid, and the net GST liability. This overview helps in quick review and verification of the calculations.

12. Additional Notes and References: A section for notes and references where users can include additional information, such as payment dates, transaction references, or any special remarks related to specific transactions.

13. Formula and Calculation Area: This hidden or protected section contains the formulas and calculations used to automate the GST computations. It ensures that the calculations are consistent and accurate throughout the template.

Example Layout of GST Payable Calculator Template

| Date | Invoice Number | Description | Original Price | Tax Rate | GST Amount | Total Amount | Vendor Payment | Courier Charges | Cess Amount | Type of Transaction | GST Liability |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 19/07/23 | 12345 | Item Description | 1000 | 18% | 180 | 1180 | 1000 | 50 | 20 | Inter-state | 160 |

| 24/07/23 | 67890 | Item Description | 5000 | 12% | 600 | 5600 | 5000 | 100 | 50 | Intra-state | 550 |

Incorporating these components ensures that the GST Payable Calculator Template is comprehensive and capable of handling all aspects of GST calculation. This setup helps businesses maintain accurate records, comply with GST regulations, and streamline the GST filing process.

Designing a Monthly GST Payable Calculator

Creating a Monthly GST Payable Calculator in Excel involves structuring the sheet to capture all relevant sales and purchase transactions, applying the correct GST rates, and calculating the GST output and input taxes. Here’s a detailed guide on how to set up and use this calculator:

Determining GST Output Tax

Step 1: List Sales Transactions

Create a table in Excel to record all sales transactions for the month. Include columns for the date, invoice number, description of goods or services, original price, and applicable GST rate.

Example:

| Date (A) | Invoice Number (B) | Description (C) | Original Price (D) | GST Rate (I) | GST Output Tax (F) | Total Amount (G) |

|---|---|---|---|---|---|---|

| 01/05/2024 | INV001 | Product A | 1000 | 18% | =D*E | =D+F |

| 02/05/2024 | INV002 | Product B | 5000 | 12% | =D*E | =D+F |

Step 2: Apply GST Rates

In the GST Rate column, input the applicable GST rate for each sale. Use a simple percentage calculation to determine the GST output tax.

Formula:

GST Output Tax = Original Price * GST Rate

Step 3: Calculate GST Output Tax

In the GST Output Tax column, use a formula to multiply the original price by the GST rate. This calculation will give you the GST amount for each sale.

Step 4: Sum the Total GST Output Tax

At the bottom of the GST Output Tax column, use the SUM function to get the total GST output tax for the month.

Example Formula:

=SUM(F2:F100)

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Determining GST Input Tax

Step 1: List Purchase Transactions

Create a table in Excel to record all purchase transactions for the month. Include columns for the date, invoice number, description of goods or services, original price, and applicable GST rate.

Example:

| Date (A) | Invoice Number (B) | Description (C) | Original Price (D) | GST Rate (E) | GST Input Tax (F) | Total Amount (G) |

|---|---|---|---|---|---|---|

| 01/05/2024 | PUR001 | Raw Material A | 2000 | 18% | =D*E | =D+F |

| 02/05/2024 | PUR002 | Service B | 3000 | 12% | =D*E | =D+F |

Step 2: Apply GST Rates

In the GST Rate column, input the applicable GST rate for each purchase. Use a simple percentage calculation to determine the GST input tax.

Formula:

GST Input Tax = Original Price * GST Rate

Step 3: Calculate GST Input Tax

In the GST Input Tax column, use a formula to multiply the original price by the GST rate. This calculation will give you the GST amount for each purchase.

Step 4: Sum the Total GST Input Tax

At the bottom of the GST Input Tax column, use the SUM function to get the total GST input tax for the month.

Example Formula:

=SUM(F:F)

Summary and Net GST Payable

After calculating both the GST output tax and GST input tax, the next step is to determine the net GST payable.

Step 1: Calculate Total GST Output Tax

Use the SUM function to total the GST output tax for all sales transactions.

Step 2: Calculate Total GST Input Tax

Use the SUM function to total the GST input tax for all purchase transactions.

Step 3: Calculate Net GST Payable

Subtract the total GST input tax from the total GST output tax to determine the net GST payable.

Example:

| Description | Amount |

|---|---|

| Total GST Output Tax | =SUM(F:F) |

| Total GST Input Tax | =SUM(F:F) |

| Net GST Payable | =B2-B3 |

By following these steps, you can set up a comprehensive Monthly GST Payable Calculator in Excel. This will help you keep track of your GST liability, ensure accurate calculations, and streamline the GST filing process.

Processing GST Payments

Once you have calculated your GST liability using your Excel GST Payable Calculator, the next step is to make the GST payment to the government. The process involves understanding the different modes of payment and selecting the one that suits your business needs.

Various Methods for Paying GST

Registered taxpayers can pay their GST liability using several modes. Here’s a detailed overview of each payment mode available through the GST Portal:

Online Payment Modes

a. Net Banking

Net banking is a convenient and secure way to pay GST directly from your bank account. Most major banks provide the facility to pay GST through their online banking portals.

Steps:

- Log in to the GST Portal.

- Navigate to the ‘Services’ section and select ‘Payments’.

- Generate a Challan by filling in the required details.

- Choose ‘Net Banking‘ as the payment mode.

- Select your bank and proceed to the net banking portal.

- Complete the payment process by authorizing the transaction.

b. Credit/Debit Card

You can also use your credit or debit card to pay GST. This method is fast and can be done anytime from the comfort of your home or office.

Steps:

- Follow the same initial steps as net banking to generate a Challan.

- Choose ‘Credit/Debit Card’ as the payment mode.

- Enter your card details and authorize the payment.

c. UPI (Unified Payments Interface)

UPI is another quick and convenient method to pay GST, allowing you to transfer funds directly from your bank account using a UPI ID.

Steps:

- Generate a Challan on the GST Portal.

- Choose ‘UPI’ as the payment mode.

- Enter your UPI ID and approve the transaction using your UPI app.

2. Offline Payment Modes

For those who prefer offline methods, GST payments can also be made through authorized banks.

a. Over the Counter (OTC)

You can pay GST in cash, cheque, or demand draft by visiting the designated branches of authorized banks.

Steps:

- Generate a Challan on the GST Portal.

- Choose ‘Over the Counter’ as the payment mode.

- Select the bank where you wish to make the payment.

- Take the printout of the Challan and visit the bank branch.

- Complete the payment by submitting the Challan along with the payment.

Filing GST Returns

After making the payment, the next crucial step is to file your GST returns. Filing returns such as GSTR-3B ensures that the tax paid is accurately reported to the GST authorities.

Steps to File GST Returns:

- Log in to the GST Portal: Use your registered taxpayer credentials to access your account.

- Navigate to Returns Filing: Go to the ‘Returns’ section and select ‘File Returns’.

- Select the Relevant Return Form: Choose the appropriate return form (e.g., GSTR-3B) based on your filing requirements.

- Enter Details: Fill in the required details, including sales, purchases, tax paid, and input tax credit claimed.

- Submit: Review the entered details for accuracy and submit the return.

- Acknowledgment: Once submitted, an acknowledgment receipt is generated. Keep this for your records.

FAQs

How to Calculate GST in Excel Sheets?

To calculate GST in Excel sheets, create columns for the original amount in Indian Rupees, the GST rate, and the GST amount. Use formulas to calculate GST by multiplying the original amount by the GST rate. You can then add the GST amount to the original amount to get the total amount including GST.

How to Calculate GST Formula?

The formula to calculate GST is: GST Amount = Original Amount × GST Rate. To find the total amount including GST, add the GST amount to the original amount: Total Amount = Original Amount + GST Amount.

How do you Calculate the Amount of GST?

To calculate the amount of GST, multiply the original price of the product or service by the applicable GST rate. For example, if the GST rate is 18% and the original price is ₹1,000, the GST amount would be ₹180 (1,000 × 0.18).

How to Remove GST Amount from Total Amount?

To remove GST from a total amount, divide the total amount by (1 + GST rate). For example, if the total amount is ₹1,180 and the GST rate is 18%, divide ₹1,180 by 1.18 to get the original amount, which is ₹1,000.

What is the TDS for GST?

TDS (Tax Deducted at Source) for GST in India refers to the tax that is deducted at the time of making certain payments to suppliers. This deduction is usually at a rate of 2% on the payment made to the supplier and is applicable under specific conditions as prescribed by the GST law.

What is GST with an Example?

GST (Goods and Services Tax) in India is a comprehensive, multi-stage, destination-based tax levied on every value addition. For example, if a manufacturer sells goods to a wholesaler for ₹1,000 and the GST rate is 18%, the wholesaler pays ₹1,180 (₹1,000 + ₹180 GST). When the wholesaler sells to a retailer for ₹1,500, the GST is calculated on ₹1,500, and the retailer pays ₹1,770 (₹1,500 + ₹270 GST).