Key Takeaways

- Streamlined Integration: Pice’s cloud-based GST reconciliation software seamlessly integrates with the GST portal and accounting systems, eliminating manual data entry.

- Advanced Matching: Utilizes sophisticated algorithms for precise invoice matching, handling complex discrepancies with ease.

- Real-Time Alerts: Offers real-time discrepancy detection and alerts, enabling prompt resolution of mismatches in GST data.

- Enhanced Collaboration: Features built-in communication tools for direct interaction with suppliers, speeding up the resolution process.

- Comprehensive Dashboard: Provides a user-friendly dashboard for a clear overview of reconciliation status, supporting better compliance and decision-making.

GSTR-2A reconciliation involves comparing the invoices uploaded by suppliers in their GSTR-1 (a monthly or quarterly return that summarizes all sales) to the purchase records maintained by a buyer. This is crucial because the input tax credit (ITC) a business claims must match the records the government has, which are based on what the suppliers report.

Are you looking for best GSTR-2A reconciliation Software? Your search wait is over as Pice Business Payment app offers a leading solution for GSTR-2A reconciliation, making it an ideal choice for businesses seeking to streamline their GST compliance process.

It stands out with its user-friendly interface and robust features, designed to simplify the complex task of matching purchase invoices with GSTR-2A data efficiently.

Why use faster GST reconciliation software?

- Accuracy: Pice software helps in accurately matching large volumes of data (invoices) automatically, reducing human errors.

- Efficiency: Speeds up the process of reconciliation, saving significant time and effort that can be redirected to other business operations.

- Compliance: Ensures compliance by identifying mismatches early, allowing businesses to take corrective action before filing of GST returns.

- Reporting: Generates reconciliation reports that can be used for filing returns and for audit purposes.

Types of GST Reconciliation Software Features

- Cloud-Based Solutions: Allow businesses to access data and perform reconciliations from anywhere, ensuring flexibility and scalability.

- Advanced Reconciliation Tools: Include features like auto-matching with rule-based exceptions, handling cross-year and cross-rule discrepancies.

- One-Click Reconciliation Facilities: Simplify the process to a few clicks, making it user-friendly.

- Error Detection and Correction: Automatically detect errors and provide suggestions for correction, streamlining the process of amending entries.

- Integration Capabilities: Seamlessly integrate with existing ERP or accounting software, ensuring that the data across platforms is synchronized and up-to-date.

- Dashboard Reporting: Provide visual dashboards that give a quick overview of the reconciliation status, highlighting mismatches, unresolved invoices, and potential ITC claims.

Purpose of Reconciling GSTR 2A with the Purchase Register

The purpose of reconciling GSTR-2A with the purchase register is multifaceted, primarily revolving around ensuring accuracy in the recording and claiming of Input Tax Credits (ITC) under the Goods and Services Tax (GST) system in India. Here’s a detailed look into why this reconciliation is critical:

Ensuring Accurate Claim of Input Tax Credits (ITC)

- Verification of ITC Claims: Reconciliation ensures that the input tax credit that a business claims on its purchases corresponds to the tax information that its suppliers have uploaded on the GST portal. This is crucial because the buyers can only claim the ITCs that the suppliers have included in the GSTR-2A form.

- Compliance with GST Regulations: Accurate reconciliation helps businesses comply with GST regulations, reducing the risk of penalties for non-compliance or erroneous claims.

Identification and Correction of Discrepancies

- Spotting Errors: It helps in identifying discrepancies such as missing invoices or mismatched invoice details (e.g., GSTIN, invoice number, and invoice date), which can affect the amount of ITC claimed.

- Rectifying Errors: Once discrepancies are identified, businesses can take timely actions to rectify them, either by reaching out to suppliers to correct their filings or amending their records.

Financial Integrity and Reporting Accuracy

- Reliability of Financial Records: Accurate reconciliation helps in maintaining the integrity of financial records by ensuring that all transactions are accounted for and appropriately documented.

- Audit Trail: It creates a robust audit trail that is essential during financial audits and inspections, reducing the likelihood of audit discrepancies and the associated financial repercussions.

Optimization of Cash Flows

- Maximizing Tax Credits: By ensuring that all eligible ITC is accurately claimed, businesses can optimize their cash flows. Proper reconciliation can potentially lower the net GST payable by accurately claiming all entitled credits.

Usage of GSTR-2A Reconciliation in Practical Scenarios

- Before Filing Returns: Typically, reconciliation should be done before filing the monthly GSTR-3B returns to ensure that the ITC claimed is accurate and fully substantiated by the GSTR-2A form.

- During Financial Closing: Reconciliation plays a crucial role during financial year-end closing by ensuring that all tax credits are correctly accounted for in the financial statements.

Features of GST Reconciliation Tools

The features of GST reconciliation tools are designed to streamline and simplify the complex process of reconciling GSTR-2A with purchase records. These tools aim to enhance accuracy, save time, and ensure compliance with GST regulations.

Here’s a breakdown of key features you can expect from effective GST reconciliation software:

- Automated Data Fetching

Integration with GST Portal: Tools automatically fetch data from the GST portal, including GSTR-2A forms, ensuring up-to-date and accurate data retrieval without manual intervention.

Direct Import from Accounting Software: They can also directly import purchase registers from accounting software like Tally, SAP, or QuickBooks, facilitating seamless data synchronization. - Advanced Invoice Matching Algorithms

Auto-Matching Capabilities: These tools use sophisticated algorithms to match invoices based on parameters such as GSTIN, invoice number, date, and tax amount, reducing manual workload.

Handling Complex Scenarios: They effectively manage cross-year and rule-based reconciliations, addressing issues like date mismatches or tax rate variations between recorded and reported transactions. - Real-Time Discrepancy Identification

Error Detection and Alerts: The software identifies mismatches or missing entries in real-time, providing alerts so that businesses can take immediate corrective action.

Detailed Discrepancy Reports: Users receive detailed reports outlining mismatches, which help in understanding the nature of discrepancies and facilitate resolution with suppliers. - Dashboard and Analytics

Comprehensive Dashboard: A visual dashboard presents a snapshot of the reconciliation status, highlighting key metrics such as matched invoices, pending actions, and potential ITC recovery.

Analytics and Insights: Advanced tools offer analytical insights that help businesses understand patterns in discrepancies, aiding in better financial planning and compliance strategies. - Collaborative Features

Supplier Communication: Some tools offer built-in communication features to directly contact suppliers from within the platform for quick resolution of discrepancies.

Multi-user Access: Businesses can grant access to multiple users, enabling collaborative work on reconciliation tasks, which is particularly useful for larger organizations with dedicated finance teams. - Compliance and Reporting

Accurate GST Compliance: By ensuring accurate reconciliation, these tools help businesses stay compliant with GST laws, reducing the risk of penalties due to incorrect tax filings.

Audit Ready Reports: They generate audit-ready reports that can be used during GST audits and inspections, thus preparing businesses for any scrutiny by tax authorities. - Cloud-Based Platform

Accessibility and Security: Cloud-based reconciliation tools offer the advantage of being accessible from anywhere, providing flexibility to manage GST tasks remotely while ensuring data security and integrity. - Customization and Scalability

Custom Rules and Filters: Businesses can set custom rules and filters according to their specific needs, which is essential for handling unique cases specific to their operations.

Scalable Solutions: The software can handle varying volumes of data, making it suitable for both small businesses and large enterprises.

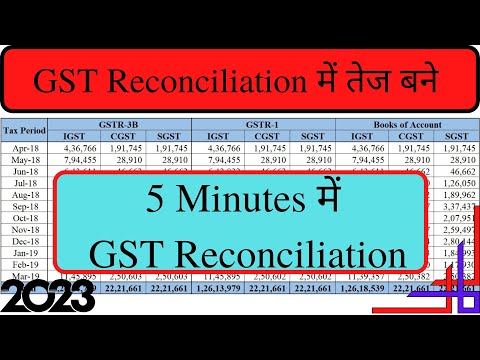

Comparing Expenses with GST Reconciliation Data

Comparing expenses with GST reconciliation data is a vital financial practice for businesses to ensure accuracy in their financial records and compliance with GST regulations. This process involves aligning the records of purchases and expenses against the GST credits as recorded in GSTR-2A, which is auto-populated based on suppliers’ filings. Here’s how this comparison benefits a business and what it typically entails:

Purpose of Comparing Expenses with GST Reconciliation Data

- Accuracy in Financial Reporting: This comparison ensures that all recorded transactions are accurate and reflect actual business expenditures that qualify for GST credits. It helps identify any discrepancies between what was reported by suppliers and what was actually paid, thus ensuring financial statements accurately reflect business activities.

- Maximization of Input Tax Credit (ITC): By reconciling GSTR-2A data with purchase records, businesses can ensure they are claiming the maximum amount of ITC available. This directly impacts cash flow and operating costs, as more ITC claimed means less cash outflow in terms of GST payments.

- Compliance with Tax Laws: Regularly comparing these figures helps maintain compliance with GST laws. It highlights mismatches or errors that need to be addressed before filing returns, thereby reducing the risk of penalties due to non-compliance or incorrect transactions / filings.

- Audit Readiness: Having reconciled and well-documented financial records ensures that a business is prepared for any audits by tax authorities. Auditors may look for alignment between purchase records and GST filings, and discrepancies could lead to further scrutiny or reassessment.

How the Comparison is Conducted

- Data Collection: The first step involves collecting the relevant data. This includes the GSTR-2A form from the GST portal, which details the GST inputs credited to the business based on suppliers’ GST filings, and the business’s own purchase register.

- Matching Transactions: Using reconciliation tools or spreadsheets, businesses match invoices listed in the GSTR-2A with those in their purchase records. Key details such as invoice number, date, GSTIN of the supplier, and tax amounts are compared.

- Identifying Discrepancies: Any discrepancies between the two sets of data are flagged. These might include missing invoices in GSTR-2A, mismatches in tax amounts, or invoices that the business has not recorded but appear in GSTR-2A.

- Resolving Issues: Discrepancies need to be resolved by either contacting suppliers to correct their filings or adjusting the business’s own records. This step is crucial to ensuring that all eligible ITC is claimed and that the records accurately reflect taxable activities.

- Documentation and Reporting: Keeping detailed records of the reconciliation process and outcomes is essential. These documents can be used for internal audits, future reconciliations, and as evidence of compliance in case of external audits.

GSTR-2A Reconciliation Tool Process

The process of GSTR-2A reconciliation using a tool involves several systematic steps to ensure that the data between the GSTR-2A auto-drafted form and a company’s purchase register is accurate and reconciled. Validating the input tax credit (ITC) claims made by businesses on their purchases is essential. Here’s an overview of the GSTR-2A reconciliation tool process:

Step-by-Step Process Using a GSTR-2A Reconciliation Tool

Step 1: Data Importation

From the GST Portal: The reconciliation tool first imports the GSTR-2A data from the GST portal. This data includes details about the invoices on which suppliers have charged GST and reported to the government.

Accounting Software: Simultaneously, the tool imports the purchase register from the business’s accounting software or ERP system. This register contains records of all purchases made by the business.

Step 2: Auto-Matching of Invoices

The tool automatically matches the invoices from the GSTR-2A with those in the purchase register. Key matching parameters include the GSTIN of the supplier, invoice number, invoice date, and tax amounts.

Advanced tools use sophisticated algorithms to handle variances in data entry, such as minor differences in invoice numbers or date formats.

Step 3: Identification of Mismatches and Missing Entries

Unreconciled Invoices: The tool identifies invoices that appear in the purchase register but not in the GSTR-2A, and vice versa.

Discrepancies in Values: It also flags discrepancies in tax amounts or other details where the records do not align perfectly.

Step 4: Resolution of Discrepancies

The tool allows users to review mismatches and take appropriate actions. This might involve reaching out to suppliers to rectify their filings or amending the business’s own records to correct GST return errors.

Some tools provide the functionality to send emails or messages directly to suppliers from within the platform to resolve discrepancies quickly.

Step 5: Reconciliation Reports

Upon completion of the reconciliation process, the tool generates detailed reports that summarize the reconciliation outcomes, including matched invoices, mismatches, and corrective actions taken.

These reports are crucial for audit purposes and the filing of accurate GST returns.

Step 6: Continuous monitoring and updates

The reconciliation process is not a one-time activity; it needs to be done regularly, as suppliers may file late or revise their previously filed returns. Many tools offer continuous monitoring and alert the user when new data is available on the GST portal that affects previously reconciled periods.

How to Reconcile GSTR-2A: Brief Guide

Among other platforms, it provides a structured tool for reconciling GSTR-2A. The process generally involves:

- Uploading your purchase registration to the platform.

- The tool fetches your GSTR-2A data from the GST portal.

- It then compares the two sets of data, identifies mismatches, and provides options to resolve discrepancies.

How to Reconcile GSTR 2A with the Purchase Register in Excel

Here’s a brief guide on how to reconcile GSTR-2A using the tools available on the Government portal and other related software solutions. This process is key to ensuring that the input tax credit (ITC) claimed matches the records reported by your suppliers, thus ensuring compliance and accuracy in your GST filings.

Step 1: Access GSTR-2A Data

Login to the GST Portal: Start by logging into the GST government portal. Under the ‘Services’ menu, navigate to ‘Returns Dashboard’ and select the financial year and the return filing period for which you want to view the GSTR-2A.

Download GSTR-2A Report: GSTR-2A is auto-populated based on the filings by your suppliers. Download the GSTR-2A data for the period you are reconciling.

Step 2: Prepare Purchase Register

Compile Purchase Transactions: Gather your purchase transactions from your accounting software or ERP system. This should include all invoices for which you have received goods or services and have tax credit eligibility.

Format Data Consistently: Ensure that the invoice data in your purchase register is formatted consistently, especially dates, invoice numbers, and GSTIN details, to facilitate accurate matching.

Step 3: Reconcile Using Software

Use Reconciliation Software: While you can manually reconcile using spreadsheets, using dedicated GST reconciliation software like Pice can automate and simplify the process. These tools typically offer features like bulk upload, auto-matching, and mismatch reporting.

Upload Data: Upload your purchase register and the GSTR-2A data into the software. Follow the tool’s instructions to map fields correctly, if required.

Step 4: Automated Invoice Matching

Matching Invoices: The software will automatically compare entries from your purchase register with the GSTR-2A. It checks for matches based on criteria such as GSTIN, invoice number, invoice date, and taxable value.

Identify Mismatches: The tool flags invoices that do not match. Common problems include missing invoices in GSTR-2A that are present in the purchase register, discrepancies in invoice values, or invoices that suppliers record in a different period.

Step 5: Review and Resolve Discrepancies

Analyze Mismatches: Carefully review each mismatch. Determine if it’s due to a supplier’s delayed filing, data entry errors in your records, or discrepancies in invoice details.

Communicate with Suppliers: For mismatches due to supplier errors, communicate with your suppliers to correct their filings. Many tools offer direct communication features for sending queries to suppliers.

Step 6: Document and Report

Documentation: Maintain detailed records of the reconciliation process, including evidence of communication with suppliers and any adjustments made.

Reporting: Generate reconciliation reports through the software. These reports are useful for audit trails and may be required for GST audits.

Step 7: Continuous Monitoring

Regular Reconciliation: Since suppliers can upload or amend their invoices on subsequent dates, regularly reconcile GSTR-2A to capture any changes and ensure your ITC claims are always accurate.

Stay Informed on Updates: Keep abreast of any changes in GST laws and guidelines that might affect the reconciliation process.

Automated GST Reconciliations

Automated GST reconciliations have become an essential part of managing Goods and Services Tax (GST) compliance for businesses in India. These automated systems significantly reduce the burden of manual data entry, increase accuracy, and help maintain compliance by ensuring all transactions are properly accounted for and reported. Here’s how automated GST reconciliations work and the benefits they offer:

How Automated GST Reconciliations Work

Integration with Financial Systems: Automated reconciliation tools typically integrate with a company’s accounting software or ERP system. This integration allows for the direct import of purchase and sales registers, eliminating the need for manual data entry.

- Fetching Data from GST Portal: These tools automatically fetch GSTR-2A and GSTR-2B data from the GST portal. The auto-populated returns GSTR-2A and GSTR-2B include information about the purchases and input credits that suppliers have reported.

- Matching Invoices: The software compares invoices from the GSTR-2A/2B with the business’s purchase records. It checks for discrepancies in GSTIN, invoice number, date, and taxable value. Advanced algorithms help in identifying mismatches even when there are minor differences in data entry.

- Error Identification and Alerts: When discrepancies are found (e.g., mismatched invoice details, missing invoices, or unclaimed input tax credits), the system alerts the user. This prompt identification helps businesses address issues proactively.

- Reconciliation Dashboards: Most reconciliation software provides a dashboard view that gives an overview of the reconciliation status, highlighting matched, mismatched, and missing entries. These dashboards are crucial for finance teams to monitor the progress and status of their GST filings.

- Reports and Documentation: Once reconciliation is complete, the software can generate detailed reports that can be used for GST filings, audits, and internal financial analysis. These reports are designed to provide insights into tax liabilities, ITC claims, and potential compliance risks.

Benefits of Automated GST Reconciliations

- Time Efficiency: Automation significantly speeds up the reconciliation process, freeing up valuable resources for other tasks.

- Accuracy: Automated systems reduce human error in data handling, increasing the accuracy of filings and financial records.

- Compliance: Timely reconciliation ensures compliance with GST regulations, helping businesses avoid penalties for late or incorrect filings.

- Cost-Effective: While there is an initial cost in implementing these systems, they are cost-effective in the long run due to reduced labor costs and decreased risk of compliance-related fines.

- Scalability: Automated systems can easily handle large volumes of data, making them suitable for businesses of all sizes.

Popular GST Reconciliation Software

Pice is widely used in India for GST reconciliation. These platforms offer cloud-based solutions, ensuring data is accessible from anywhere and is always up-to-date. They also include features like multi-level reconciliation processes, which can handle complex scenarios across various billing cycles and financial years.

Conclusion

GSTR-2A reconciliation is a crucial aspect of GST compliance that ensures businesses accurately claim their entitled input tax credits. Regular and thorough reconciliation helps in maintaining financial accuracy and avoiding potential conflicts with tax authorities, thereby safeguarding the financial health of the business.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

FAQs

What happens if there is a mismatch in GSTR-2A reconciliation?

Mismatches can arise due to various reasons, such as discrepancies in invoice details entered by the supplier, delayed filing by the supplier, or errors in data entry. When mismatches occur, businesses need to communicate with their suppliers to correct the invoices or update their own records to reflect the accurate information. Failure to resolve these mismatches can lead to a denial of input tax credit claims.

How often should GSTR-2A reconciliation be performed?

It’s recommended to perform GSTR-2A reconciliation monthly to ensure timely identification and resolution of discrepancies. This aligns with the monthly filing of GSTR-3B (summary return), where accurate ITC claims are essential.

Can GSTR-2A reconciliation impact financial statements?

Yes, reconciliation impacts financial statements. Accurate reconciliation ensures that the input tax credits are correctly claimed and reported in the financial statements, affecting tax liabilities and net profit figures.

Is there a deadline for reconciling GSTR-2A?

While there isn’t a specific deadline for the reconciliation itself, it should ideally be completed before filing the GSTR-3B for the month to ensure accurate input tax credit claims. The deadline for GSTR-3B filing typically falls on the 20th of the following month.

What tools can assist in GSTR-2A reconciliation?

There are several tools and software solutions available that automate and facilitate GSTR-2A reconciliation, such as Pice, ClearTax, Zoho Books, Tally ERP. These tools help in automating data import, matching invoices, and resolving discrepancies.

What are the penalties for not reconciling GSTR-2A?

While there are no direct penalties for not reconciling GSTR-2A, discrepancies that are not resolved can lead to a denial of input tax credit, resulting in higher tax payments. Additionally, inaccurate reporting can attract penalties under GST audits.

How do I deal with old, unmatched invoices in GSTR-2A?

For older, unmatched invoices, it’s important to reach out to the supplier to either get the invoice corrected or to adjust the entries in subsequent months. The GST framework allows adjustments to be made in returns for a financial year until the due date of the September return of the following year or the date of filing of the annual return, whichever is earlier.