Key Takeaways

- Dynamic QR Codes Enhance Compliance: Including dynamic QR codes on B2C invoices aligns with GST regulations, improving tax compliance and record accuracy.

- Streamlined Payments: QR codes facilitate easy and fast digital payments directly from invoices, enhancing the customer payment experience.

- Mandatory for Large Businesses: Businesses exceeding specific turnover thresholds are required to include dynamic QR codes on B2C invoices under GST rules.

- Increased Transaction Transparency: QR codes on invoices ensure that all transaction details are easily accessible, fostering transparency in consumer transactions.

- Technological Adaptation Encouraged: The implementation of QR codes on invoices pushes businesses towards digital adaptation, optimizing operations and customer interactions.

The implementation of the Goods and Services Tax (GST) in India has revolutionized the tax framework, impacting how businesses issue invoices. This article explores the intricacies of GST for different invoice types across B2B and B2C transactions.

What is B2B vs. B2C invoices?

With Goods and Services Tax (GST) implemented across various jurisdictions, understanding the differences between business-to-business (B2B) and business-to-consumer (B2C) invoices is crucial for compliance and efficient tax management. Both types of invoices play pivotal roles under GST but serve different purposes and follow distinct rules.

B2B Invoices

- Definition and Purpose: B2B invoices are issued when one registered business sells goods or services to another registered business. The primary purpose of a B2B invoice is to document the transaction for both parties so they can claim input tax credits. Input tax credits allow businesses to reduce the GST they must pay on their sales by the amount of GST they have paid on their purchases, thus only paying tax on the value addition.

Key Features

- GST Compliance: Both the supplier and recipient must be registered under GST.

- Detailed Information: This includes the GSTIN (GST Identification Number) of both the supplier and the recipient, a detailed description of the goods or services provided, the quantity, the taxable value, tax rates applied, and the total tax charged.

- Tax Credit Eligibility: Essential for enabling the recipient to claim input tax credits.

B2C Invoices

Definition and Objective: Businesses issue B2C invoices to customers who are not GST registered. These invoices are generally simpler because they do not require the extensive details needed in B2B transactions. The focus is on compliance and reporting sales to the tax authorities rather than facilitating tax credits.

Key Features

- No GSTIN of the Recipient: Unlike B2B, the GSTIN of the recipient is not required.

- Consumer Details: This usually includes less detailed information about the consumer. For large invoices (typically over a specified threshold), additional details like the name and address of the consumer might be included.

- Simplified Tax Details: This often includes a consolidated effective tax rate rather than itemized tax rates.

Key Differences

- Input Tax Credit: B2B invoices enable input tax credits, while B2C invoices do not because the recipient (consumer) is not registered to claim GST.

- Detailing: B2B invoices are more detailed to comply with tax audit requirements, whereas B2C invoices are generally streamlined for simplicity.

- GSTIN Requirement: B2B invoices require both the supplier’s and recipient’s GSTIN, while B2C invoices do not require the consumer’s GSTIN.

- Purpose: B2B invoices facilitate tax compliance and credit mechanisms between businesses, whereas B2C invoices are primarily for sales reporting and tax collection from end consumers.

B2C Small vs. Large Invoices Under GST

Small Invoices: Typically, these are invoices for sales of goods or services to consumers that fall below a specified threshold, which varies based on the GST council’s regulations. These transactions do not generally require detailed customer information.

- Definition and Criteria

- Large Invoices: These invoices are issued for transactions that exceed the defined small invoice threshold. Large invoices often require more detailed information, including, in some cases, the customer’s name and address, especially if it cross certain value limits.

- Impact of Annual Turnover

Businesses with a higher annual turnover must adhere to more stringent reporting and compliance standards. For instance, businesses exceeding the turnover threshold of Rs 20 lakhs (or Rs 10 lakhs for NE and hill states) are required to register for GST. This registration threshold directly influences how businesses issue B2C invoices.

- Applicable GST Rate

The GST rate applicable to B2C transactions can vary depending on the product or service being sold. Typically, GST rates are segmented into four primary categories: 5%, 12%, 18%, and 28%. Businesses must ensure that the correct rate is applied based on the classification of the goods or services.

- GST Returns and Compliance

All GST-registered businesses must file periodic returns, with the frequency and specifics depending on their turnover and the type of registration. B2C transactions are predominantly reported in GSTR-1, where invoice-level details of sales to consumers are provided.

Businesses with an annual turnover above Rs 1.5 crores are required to file monthly returns, whereas those below this threshold have the option to file quarterly returns under the QRMP (Quarterly Return Monthly Payment) scheme.

- Tax Liability and Input Tax Credit

In B2C transactions, businesses cannot claim input tax credit on the GST collected from consumers. This contrasts with B2B transactions, where input tax credit can be utilized to offset GST liabilities on inputs against outputs.

The final tax liability for B2C sales is borne by end consumers, making compliance and accurate tax rate application crucial for businesses.

- Impact of GST on B2C Transactions

GST has unified the earlier multiple taxes into a single tax, aiming to make the tax process simpler and create a transparent business environment. For B2C transactions, this means streamlined invoice formats and potentially lower compliance burdens over time.

The implementation of GST has also facilitated easier interstate sales due to the centralized registration system and the removal of cascading taxes.

The Three Categories of GST

The three principal categories—Central GST (CGST), State GST (SGST), and Integrated GST (IGST)—are crucial for businesses to navigate compliance, manage tax liabilities, and ensure accurate invoicing, especially across diverse transaction types, including inter-state and intra-state supplies. Here’s a breakdown of each category and its implications for registered businesses, unregistered persons, and the broader economic landscape under GST.

- Central GST (CGST)

Definition: CGST is the tax levied by the Central Government on intra-state sales (sales within the same state). It is charged along with SGST, which goes to the state.

Key Aspects

- Tax Collection: Collected by the Central Government.

- Usage of Credits: Taxpayers can utilize the input tax credit (ITC) of CGST against CGST or IGST payments, but not against SGST.

- State GST (SGST)

Definition: SGST is the counterpart to CGST, levied by individual State Governments on intra-state sales. It complements CGST, ensuring that the state also benefits from GST on local sales.

Key Aspects

- Tax Collection: Collected by the State Government.

- Usage of Credits: ITC of SGST can be used to pay SGST or IGST due on sales but cannot be used against CGST.

- Integrated GST (IGST)

Definition: IGST is charged on inter-state supplies (sales between different states) and imports. It is designed to ensure that tax revenue is shared between the originating and destination states.

Key Aspects

- Tax Collection: Collected by the Central Government.

- Distribution: The IGST collected is shared between the Central and State Governments as per the rates agreed upon by both.

- Usage of Credits: ITC of IGST can be utilized for payment of IGST, CGST, and SGST in that order, which helps in the seamless flow of credit across states and reduces tax cascading.

Implications for Various Stakeholders

- Registered Businesses: Must adhere to GST regulations by calculating the correct type of GST depending on whether the transaction is inter-state or intra-state. Compliance with GST requirements, including accurate GST returns filing through the GST portal, using forms like GSTR-1, is mandatory.

- Unregistered Persons: They are not required to charge GST, but they cannot claim ITC. This can affect pricing strategies and market competitiveness, especially when dealing with registered businesses.

- Impact on Prices to Consumers: Ideally, GST should lower the tax burden on consumers due to the seamless flow of tax credits throughout the supply chain. However, the actual impact can vary based on the implementation and compliance levels of businesses.

- Compliance Burden: The introduction of GST has unified multiple indirect taxes, potentially reducing the compliance burden for businesses operating across state lines. However, the need for detailed invoice tracking and proper classification of goods and services for tax rate application can still pose challenges.

What Qualifies as a Taxable Entity?

A taxable entity under GST refers to any individual or business that is required to register under GST and charge GST on taxable supplies of goods or services. The criteria and implications of being a taxable entity have evolved from the previous tax regime to the current unified system.

Criteria for a Taxable Entity Under GST

- Aggregate Turnover: A key determinant for GST registration is the aggregate turnover of a business. This includes the total value of all taxable supplies, exempt supplies, exports of goods and/or services, and inter-state supplies of a person having the same PAN. The current threshold for GST registration is Rs 20 lakhs for most states and Rs 10 lakhs for North-Eastern and hill states.

- Inter-State Supplies: Any business involved in inter-state supplies must register for GST, regardless of turnover. This is a significant shift from the previous tax regime, where businesses could operate across state lines without such stringent central oversight.

- Taxable Supplies: Businesses that deal in goods and services that are defined as taxable under GST must register and comply with GST requirements. This includes most goods and services, with specific exemptions provided by the law.

- Involuntary Registration: In some cases, entities might be required to register for GST involuntarily. This includes businesses that receive goods or services from unregistered persons and are liable to pay GST under the reverse charge mechanism.

Implications of Being a Taxable Entity

- Compliance Requirements: Registered businesses must comply with various compliance mandates, such as filing regular returns (e.g., GSTR-1, GSTR-3B), maintaining detailed invoices, and adhering to e-invoicing requirements for certain thresholds.

- GST Invoicing: Every taxable entity is required to issue a tax invoice for all taxable sales, detailing the amount of GST charged. This invoice is crucial for both the supplier and customer,, as it enables the claiming of input tax credit (ITC).

- Electronic Invoicing: For businesses with a turnover exceeding a specified limit (currently Rs 50 crores), electronic invoicing (e-invoicing) is mandatory. This involves the generation of invoices on the GST portal before conducting transactions.

- Impact on Business Operations: Being a registered GST entity affects various aspects of business operations, including pricing strategies, accounting systems, and tax liability management. It also ensures that businesses can claim ITC on their inputs, effectively reducing the cost of raw materials and other inputs.

Transition from Previous Tax Regime

Businesses frequently had to navigate a variety of indirect taxes under the previous tax system, including the state- and federal-imposed excise, service tax, and VAT. The introduction of GST unified these into a single tax system, simplifying compliance but also broadening the scope of taxable entities through its comprehensive criteria.

E-Invoicing Overview

The adoption of electronic invoicing (e-invoicing) under the Goods and Services Tax (GST) framework is transforming how business transactions are conducted, particularly for B2C (Business-to-Consumer) businesses.

This move towards e-invoicing is intended to curb tax evasion, simplify compliance, and promote a unified market by standardizing the format and automation of invoice generation. Here’s an overview of e-invoicing for B2C businesses, highlighting key components, compliance requirements, and the impact on taxation processes.

Overview of E-Invoicing for B2C Businesses

- What is E-Invoicing? E-invoicing involves the electronic generation and submission of invoices using a standard format directly accessible by the GST system. It aims to integrate all business transactions into a digital framework that ensures real-time tracking of sales and tax liabilities.

- Applicability to B2C Transactions Initially, e-invoicing in India was mandated for B2B transactions for businesses exceeding a certain turnover threshold. As of now, the implementation for B2C transactions is under review, with potential future applicability expected to streamline consumer transactions as well.

Key Components of E-Invoicing

- Invoice Registration Portal (IRP): B2C businesses may need to use the Invoice Registration Portal (IRP) to authenticate and validate invoices, a process that generates a unique invoice reference number (IRN) and QR code, ensuring the invoice is GST compliant.

- Real-Time Data Accessibility: The real-time transmission of invoice data to the GST portal facilitates immediate data availability for tax authorities, reducing the lag in tax collection and enhancing compliance levels.

- Standardized Invoice Format: Adhering to a standardized invoice format simplifies the reconciliation of input tax credit for B2B transactions and could potentially ease consumer transactions by providing clearer and more consistent billing information.

Compliance and Operational Impact

- Reduction in Tax Evasion: By automating and standardizing invoice generation, e-invoicing reduces the opportunities for tax evasion, ensuring that all applicable taxes are calculated and collected accurately at the point of sale.

- Streamlined GST Returns: E-invoicing simplifies the process of filing GST returns. The details from e-invoices are automatically populated in the respective GSTR-1 return, reducing errors and the administrative burden associated with manual data entry.

- Enhanced Competitive Edge: For B2C businesses, transitioning to e-invoicing can offer a competitive advantage by enabling faster, more reliable transactions. Automated systems reduce billing errors, enhance customer satisfaction, and potentially lead to faster payment cycles.

Challenges and Considerations

- Technological Infrastructure: Implementing e-invoicing requires robust IT support. Small and medium-sized enterprises (SMEs) may face challenges due to the costs and complexity of integrating new systems.

- Customer Adaptation: Educating consumers about electronic invoices, especially in sectors where digital literacy is lower, can pose challenges. Businesses need to ensure that digital invoices are as acceptable and understandable as traditional paper-based ones.

- Regulatory Updates: As GST policies evolve, businesses must stay informed about changes in e-invoicing regulations and compliance requirements, particularly concerning the rate of GST applicable, filing of returns, and the handling of inter-state and intra-state sales.

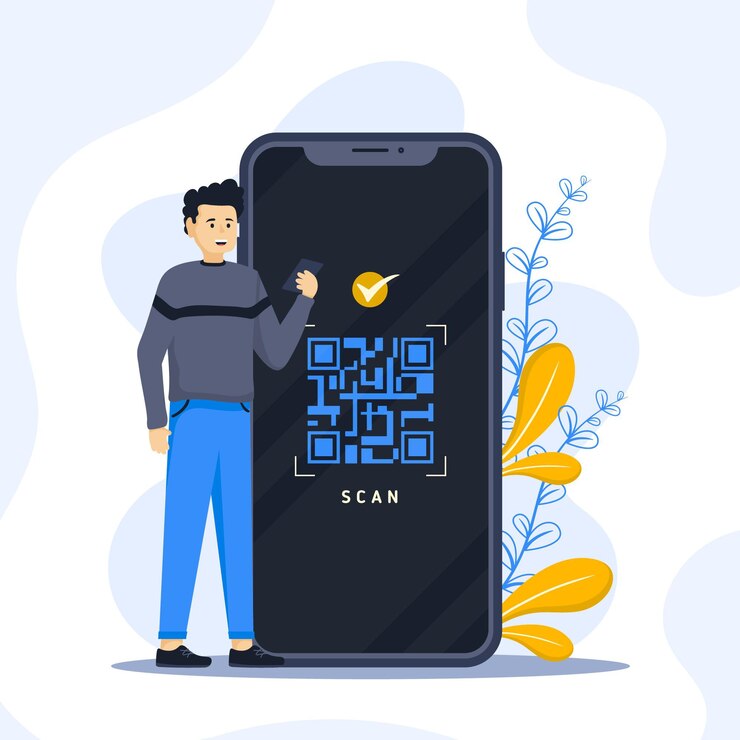

Dynamic QR Codes on B2C Invoices

Dynamic QR (Quick Response) codes on B2C (Business-to-Consumer) invoices are becoming an essential feature under the GST (Goods and Services Tax) framework, especially for enhancing transparency and compliance in taxation processes. This technology-driven initiative aims to simplify tax calculation, expedite payments, and streamline the overall consumer transaction experience.

Importance of Dynamic QR Codes on B2C Invoices

- Facilitating Digital Payments: Dynamic QR codes enable consumers to make payments directly through their smartphones, which captures the invoice details instantaneously, reducing errors and saving time.

- Compliance with GST Requirements: For certain businesses, issuing B2C invoices with a dynamic QR code is mandatory. This ensures that the businesses comply with GST norms, aiding in proper documentation and tax collection.

- Enhancing Customer Experience: QR codes on invoices simplify the checkout process for customers, leading to improved satisfaction and competitive pricing as businesses can reduce overhead costs associated with manual billing processes.

Regulatory Context and Operational Impacts

- Mandatory for Specified Taxpayers: Under GST regulations, businesses exceeding a certain annual turnover (currently set at Rs 500 crores) are required to include dynamic QR codes on their B2C invoices. This helps in the classification of taxpayers and ensures that large enterprises adhere to enhanced compliance standards.

- Accurate Tax Reporting: Dynamic QR codes help in accurate and real-time reporting of sales transactions to the GST portal, simplifying the process of tax filing returns. This is particularly beneficial in managing consolidated details of sales, especially for businesses involved in both inter-state and intra-state supplies.

- Streamlined Taxation Process: The inclusion of QR codes on invoices aligns with the digitization goals of the GST framework, making the taxation process more streamlined and less prone to errors. It also supports the GST’s aim to unify the market by making transactions traceable and transparent across different states and regions.

Who is exempt from dynamic QR codes?

Certain businesses are exempt from the requirement to include dynamic QR codes on their B2C invoices under the GST regulations. These exemptions generally apply to:

- Small Businesses: Businesses whose annual turnover is below the specified threshold set by the GST council, which currently stands at Rs 500 crores, are not required to implement dynamic QR codes on their B2C invoices.

- Special Categories: Businesses that make tax-exempt supplies or those that are wholly engaged in the supply of non-GST goods or services are also exempt from this requirement.

How to Create a QR Code for Invoices

Creating a QR code for invoices involves a straightforward process that can enhance the efficiency and compliance of business operations under GST. Here’s a concise guide on how to generate a QR code for your invoices:

Step 1: Choose a QR Code Generator: Select a reliable QR code generator that supports dynamic content and is compatible with GST requirements. Many online platforms offer this service, some of which are specifically designed for GST compliance.

Step 2: Input Invoice Details: Enter essential invoice details into the generator, including the GSTIN (GST Identification Number), invoice number, invoice date, total transaction value, and the GST amount. These details are crucial for ensuring that the QR code meets regulatory standards.

Step 3: Generate and Test the QR Code: Once the details are entered, generate the QR code. Test the QR code with different devices and scanning apps to ensure it correctly displays all the necessary invoice information.

Step 4: Incorporate into the invoice: Embed the generated QR code onto your invoice template in a position that is easily visible and scannable without obscuring any other important information.

Step 5: Educate Customers: Inform your customers about the functionality of the QR code, especially how it can be used to verify transaction details and make payments, enhancing their convenience and trust.

The Ideal B2C GST Invoice Format

An ideal B2C GST invoice format should be clear, compliant, and informative, ensuring it meets GST regulations while being easy for customers to understand. Here’s what it should include:

- Business Details: Name, address, and GSTIN of the seller.

- Customer Details: Name and address of the customer, if applicable, for transactions over a specified threshold.

- Invoice Details: Unique invoice number, date of issue, and place of supply.

- Product or Service Details: Description of goods or services, HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes, quantity, and total value.

- Tax Breakdown: Detailed breakdown of CGST, SGST, IGST, and cess applied on the taxable value.

- Total Amount: Total invoice amount, including tax.

- QR Code: A dynamic QR code that contains all vital transaction details for easy verification and payment.

Advantages in B2C Transactions

Implementing GST in B2C business-to-consumer) transactions offers several advantages that streamline the taxation process and enhance the overall customer experience. Here are some key benefits:

- Simplified Tax Structure: GST replaces multiple indirect taxes with a single tax, reducing complexity for consumers who no longer need to decipher various tax components included in the price of goods and services.

- Transparent Pricing: GST’s inclusive approach ensures that consumers see a unified price on products, which includes all tax components. This transparency helps customers understand exactly what they are paying for, fostering trust and clarity.

- Reduced Tax Burden: The input tax credit mechanism in GST prevents the cascading effect of taxes—tax on tax—which often leads to lower costs for the end consumer. Businesses can pass these savings on to consumers in the form of reduced prices.

- Improved Product Quality: With GST enforcing compliance across all stages of the supply chain, businesses are incentivized to maintain high-quality standards and proper billing practices, indirectly benefiting consumers with better products and services.

- Enhanced Consumer Rights: GST provisions help in better regulation of unorganized sectors. This standardization helps in protecting consumer rights by ensuring that businesses adhere to fair pricing and billing practices.

- Streamlined Online Purchases: GST facilitates easier and more transparent e-commerce transactions, which are growing in popularity. Consumers benefit from uniform prices irrespective of their location, enabling straightforward comparisons and purchases.

Conclusion

This comprehensive exploration of GST-related invoices shows the critical role they play in compliance and business operations in India.

The integration of dynamic QR codes into B2C invoices under the GST framework not only aligns with regulatory compliance but also significantly enhances the efficiency and transparency of consumer transactions. This technological shift is paving the way for more streamlined, secure, and consumer-friendly business operations.

💡Missing the deadlines to GST payments on time? You can download and use Pice Business Payment App to pay all your business expenses like GST, vendors, utilities, and many more, with your credit card at the cheapest price.

FAQs

How are B2B and B2C invoices different under GST?

B2B (business-to-business) and B2C (business-to-consumer) invoices differ primarily in their purpose and detail under GST. B2B invoices are detailed, including GSTINs of both the supplier and recipient, and are essential for claiming input tax credits. B2C invoices are generally issued to end consumers who do not need to claim input credits, and thus, these invoices typically do not include the customer’s GSTIN unless it is a large invoice, and are simpler with fewer details.

What is required in a B2C large invoice?

A B2C large invoice must include certain specific details to meet GST requirements. This includes the seller’s GSTIN, a detailed description of goods or services, HSN/SAC codes, quantity, total value, tax amount split into CGST, SGST, IGST, and any applicable cess. For invoices above a specified threshold, it must also include the buyer’s name and address, and a dynamic QR code for facilitating digital payments.

Why are QR codes important for GST invoices?

QR codes on GST invoices streamline several processes. They enable quick verification of invoice authenticity, facilitate digital payments, and ensure that all necessary transaction data is captured accurately and efficiently. For businesses, this leads to better compliance with GST regulations, faster transaction handling, and reduced errors in tax reporting.

What are the exemptions from creating dynamic QR codes?

Dynamic QR codes are not required on all B2C invoices. Small businesses whose turnover is below the GST prescribed limit (currently Rs 500 crores) are exempt. Additionally, businesses engaged exclusively in the supply of exempted goods or services, or non-GST goods are also exempt from this requirement.

How has GST benefited B2C transactions specifically?

GST has streamlined the tax structure for B2C transactions by replacing multiple indirect taxes with a single tax, leading to more transparent pricing and potentially lower costs for the consumer due to the elimination of the cascading effect of taxes. The uniform tax structure has also simplified interstate commerce, enhancing the ease of doing business and leading to more competitive prices across states.